Accrol Group Holdings plc (LON:ACRL) Chief Executive Officer Gareth Jenkins and Chief Financial Officer Richard Newman caught up with DirectorsTalk for an exclusive interview to discuss what’s driven progress & market share growth, their ability to pass on cost inflation to customers, key priorities for the business going into FY23 and the outlook for the company going forward.

Q1: First off, Gareth, you must be very pleased with your FY22 results, but what’s driven the progress, and the growth in market share in particular?

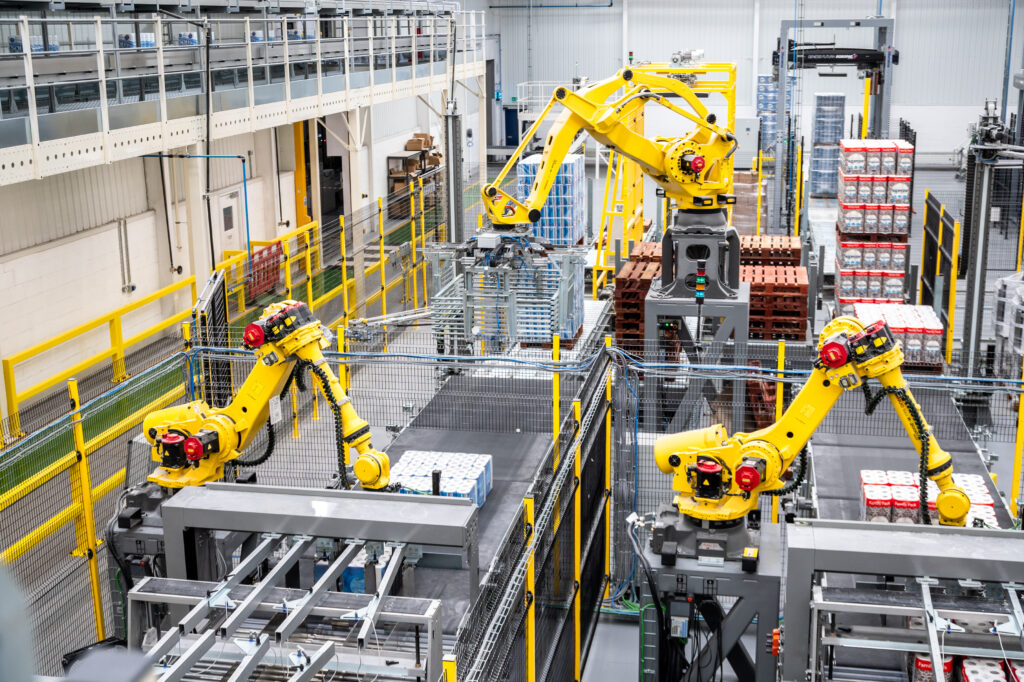

A1: We’re really pleased with the results that we announced earlier on in the week. The key part really has been the work that’s gone on over particularly the last two years with the amount of investments going to the organisation. We’ve now fully automated all of our factories in their entirety, the bulk of all of our investments is now behind us and we have some modest amount of capital spend going forward.

The business now is transformed an organisation. We’re now the lowest cost producer in the UK of toilet roll and kitchen towel, we’ve got a very strong position with all of the retailers and discounters in the UK, and the product range that we’ve got is incredibly strong, delivering a range of products for every consumer in the UK, no matter what your price point.

That’s helped us enormously in growing our market share. The business this year has grown around 17%, we’re really, really pleased with that growth but more importantly, we’ve also been able to pass through significant price increases from our input costs, which have really been driven by energy cost changes. That’s on the back of the quality of the products that we’re able to deliver to the retailers and then onto the consumers.

So, really pleased with the results and we’re really excited about progress for this year as well.

Q2: Richard, we’re in unprecedented periods with cost inflation and so on. What’s your ability to pass on through to customers and are you pulling any other levers to manage the cost base?

A2: Yes, it’s certainly been unprecedented times, I don’t think either me or Gareth have ever seen an environment quite like it.

We’ve faced very significant cost headwinds driven by, as Gareth said, energy, but other factors, the cost of pulp, the cost of haulage, the cost of shipping containers, the cost of other materials that we use in our products. So, on an annualised basis, we’ve faced headwinds of over £70 million and we have been successful in passing that cost on to our retail customers through a series of price increases during the year. They’ve been challenging conversations as you might have imagined, quite rightly given the scale of those increases. Our customers have been extremely supportive, they understand what’s driving those cost increases and so we’ve been able to pass them on.

Internally though, we’re always aware that we need to be as efficient as possible so we’re always looking for ways to become more efficient. We’ve saved another £3 million internally from our own cost initiatives, some of those have been driven by synergies from the acquisitions we made over 12 months ago.

So, we bought the Leicester Tissue Company and the John Dale wet wipes business over 12 months ago, and we’ve generated synergy benefits from that. We’ve also continued to invest in the business so we’ve now got fully automated facilities in our Blackburn site, in our Leyland manufacturing site as well, and again, those investments and that automation has driven cost out of our business as well.

We continually focus on bringing our own cost base down, but the scale of the input cost rises meant that we had to put through very significant price increases but they were achieved during the year.

Q3: Gareth, looking ahead to FY23, is the strategic review continuing? What are the key priorities for the business?

A3: The review is ongoing and I’ll come to that in a moment, but I think as we look forward to FY23, there’s been some quite significant changes in the marketplace which put Accrol Group in a very strong position. Because of the inflationary pressures that are impacting the UK, the consumer clearly now has some choices to make around the everyday products that we produce.

We’ve seen the marked change in market share, the private label now commands around 54% of the UK spend with brands declining to 46%. In the first quarter of this year, private label grew by around 10%, Accrol grew 28% in the same period and, as Richard said, that’s on the back significant investment we’ve made, the full automation of our factories and the product range that we’ve got is second to none.

So, part of that strategic review has been the company’s position in the marketplace. We’re really well positioned as a group, we have a third of the UK private label market and around 20% of the total market so we are a major player in the UK.

Part of the strategic review is around our mill development. We are ready to go with the machine specification, the building design is complete, and the location of where we want to put the mill is progressing well. Part of the delay for us has been around building costs, they have risen dramatically during this period, something that we’re seeing starting to soften so once the conditions are right for us to progress with the mill development, we will do that.

We’ve already said to our shareholders and to the market that we will fully update everyone in early ’23 but the business is now incredibly well positioned to take advantage of a significant change in the marketplace going forward.

So, we are really pleased with where we’re up to and excited about the future.

Q4: Finally, what’s the outlook like for Accrol Group in FY23, and why should investors follow you?

A4: Well, as I I touched on earlier actually, the dynamic of the market is changing rapidly. If I go back just three months, the market share between private label and brands was 50/50 and as I said earlier, it’s now 54% in favour of private label. We only see that accelerating as people get more pressure with where they spend their money, they want to look for an everyday product that we produce that gives them the right value.

The range that we’ve now got, we’ve introduced our own tertiary brands so we’ve got the fastest-growing brand in kitchen towel with Magnum, we’ve got one of the biggest growing toilet roll brands behind Andrex in our Elegance range, which is now in 30,000 convenient stores in the UK. As Richard mentioned, our flushable wet wipe business, that’s grown from £2 million annualised sale to a run rate today of £6 million in the first 12 months, we’re really excited about. We have a range of products there that are water industry approved and then our state of the art facial tissue business that was fully automated in the year, again, we see some significant growth in that market for us.

So, we’re well positioned, we believe that investors have got an opportunity of getting involved in the Accrol story. We know that we are a market leader and there’s some big advantages coming our way as the market changes quite dramatically over the next 12 months so we’re looking forward to it.