Dialight plc (LON:DIA) Chief Executive Officer Fariyal Khanbabi caught up with DirectorsTalk for an exclusive interview to discuss the highlights from 2021, supply chain issues, the launch of their Ultra Efficient Vigilant LED High Bay and the company’s key priorities and outlook.

Q1: Dialight had a particularly strong year in 2021, what would you highlight as the main points of progress?

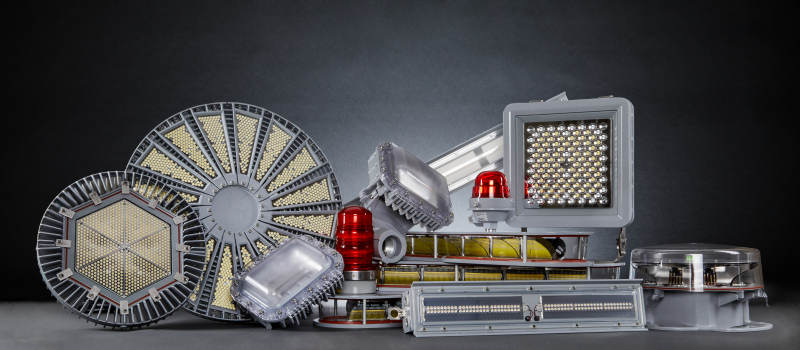

A1: The main progress we really made in 2021 was we achieved growth in a very, very difficult market and we continue to be the leader in product innovation. We had four major product launches last year, but most importantly to me, and the ethos of the company is we recognize that the company is part of a greater community and we can make a real positive impact on the environment.

As we all know, COVID-19 has presented unprecedented challenges to the business, the world, it’s hard to believe we’re nearly two years into this but it really gave us the opportunity to demonstrate the resiliency and the strength of the business.

We prioritized the help and wellbeing of our employees and their families, but we really operated the business effectively and continue to help our customers reach their carbon reduction goals. An area which I’m particularly proud of is we set up our Dialight Foundation to really help hardship in the communities where we have facilities so it’s not just about being a good employer but about giving back to the communities in which we live. We focussed very heavily on of Mexico over 2020 and 2021, and we hope to do even more good work in the other facilities that we have around the globe.

Q2: Now, you mentioned COVID 19. Have you been noticing any issues in supply chain and if so, what steps have you had to mitigate those?

A2: Supply chain, it’s hard to believe that the global supply chain is 10 times worse than it was at the start of the pandemic, you see some bottlenecks easing, you have others the one thing that we can be sure of it’s going to be a long time before we revert to normal.

The worst delays we are seeing is on the US West Coast, which a lot of our ships coming to feed our factory in Mexico, there is just not enough workers there. What we’ve had to do is we have had to work very closely with our engineering team to ensure that we have dual certified components, we’ve had to increase inventory, we’ve had to look at creative ways of bringing in components into the US, into other ports.

It is a challenge and will continue to be I think for most of this this year.

Q3: You’ve recently announced the launch of a new Ultra Efficient Vigilant LED High Bay, how do you see this being a game changer for the LED light industry?

A3: Well, the whole LED industry is all about energy efficiency and for us to bring the most efficient high bay to the market is being a great achievement and that’s really going to help our customers get to their carbon neutral goals faster.

The one thing that we’re even more excited about is that yes, it’s all about energy efficiency, but what happens at the end of the life of that fixture if it ends up in a landfill, that’s not very sustainable. So, we are looking to bring the first fully recyclable product to the market which fits with our sustainability goals.

Q4: As we’ve started now into 2022, what are Dialight’s key priorities? How do you see the outlook for the coming year?

A4: We’re excited at the current year, we’re mindful of the many headwinds we see in the global supply chain, but we are very focused on continuing to develop our product portfolio to meet the changing demands of the new market environments and generating those significant energy savings for our customers.

We’re focused on reducing our own carbon footprint, looking at the raw material inputs, increasing the energy efficiency in our operations and, as I said previously, increasing our engagement through our work in the community and also looking after doubling our efforts in terms of the wellness of our workforce.

We, as many companies are doing, are increasing the level of digital technology we’re using in our business and we’re very committed to, and very excited about, the current year.