Echo Energy plc (LON:ECHO) Chief Executive Officer Martin Hull caught up with DirectorsTalk for an exclusive interview to discuss their latest production & operational update, production and infrastructure enhancement plan and other opportunities in the portfolio.

Q1: Martin, this morning Echo Energy put out an important RNS. Can you just tell us a little bit more about that?

A1: This morning’s announcement is really very important and it’s also a very positive one. It provides the market with two key updates on important bits of information, the first is the Q2 production update and secondly, we’ve also announced an agreement with our partners for a very clear and detailed near term plan to increase our production.

Q2: Can you tell us more about the production update then first?

A2: So, we’ve announced a strong quarter of production, total average daily production across oil and gas was 1,400 barrels of oil equivalent a day, total liquids production was up again and it’s the seventh quarter in a row that liquids production has increased. Look, that that’s great news and it’s real testament to the work that’s been done in the field by the operational teams and the planning that’s associated with that.

Importantly in this quarter, we also had a big milestone as we upgraded a compressor in the Oceano field. In order to do that, we took the field offline for 35 days as we undertook the work, but since we brought it back, the production has been very encouraging, production is up over 20% which is great news.

So, all in all, to have produced these strong production rates for the quarter whilst also upgrading the infrastructure is really very encouraging.

Q3: Now, you announced today a production and infrastructure enhancement plan, why have you announced this now?

A3: The ability for us as a company to increase production levels from our Santa Cruz Sur assets is really the result of the right choices that were made during the pandemic. We created a stronger operational platform, despite the challenges, and we can now build on that.

So, having stabilised the business, we are now ready and we’re very keen be able to pivot towards growth, growth that we believe exists within the portfolio, within these assets and also with that growth, now is the time to take advantage of the current momentum in commodity prices.

So, in May, our revenue increased by over 100% versus April and that’s been supported by new gas contracts, which were at large premium to last year. This increased revenue is really a catalyst in now been able to proceed with the production increases that we’ve announced.

I think it’s very important to stress that this plan is in addition to the workover plan, one which I’ve talked about previously, those workovers remain additional opportunities and will provide further upside in due course.

For now we’re very focused on the near term production increases, which provide maximum bang for our buck. Also importantly, this plan has been agreed by all the partners in the joint venture and with our key stakeholders in the field.

Q4: Could you just talk us through then the production and infrastructure enhancement plan?

A4: Absolutely and again, this is really important and positive milestone for the company, it’s the first time that we’ve been able to come to the market with a detailed plan and a timeline to deliver a material increase in production.

So, the plan is designed to increase production at the Santa Cruz Sur asset and also to improve the quality of our liquid blends for those assets, and hence to get the highest average price for our sales liquids. Over a six month period, the partners intend to increase total production by approximately 40% from the levels that we’re in today and now if achieved, it would increase the company’s net production to around 2,000 barrels of oil equivalent a day. Also, I want to stress that the preparation for some of these activities is commencing immediately.

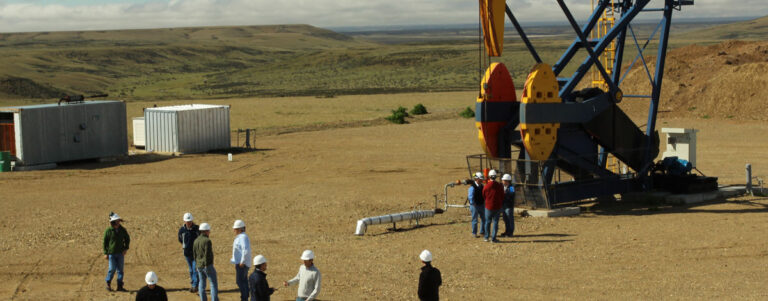

So, how will we do that? Well, the production increase is going to be driven by recommissioning and bringing back into production existing oil wells which are currently offline, and we estimate we’re going to do about 30 plus wells. These wells will be gradually brought back into production over that six month period.

In addition to bringing those wells back online, we’re going to increase and upgrade our infrastructure so that we can sustain, but also contribute to the elevated production levels.

In terms of the infrastructure, we’ve got three operational priorities:

First is to increase the electrical generation capacity so we’re going to install new generators to some of our fields, we estimate that this will take about a month.

Second is the maintenance and optimisation of the compressors and remember, we’ve done that with one of our compressors in the Oceano field, and we saw the positives of that, but we’re going to do it now with our other compressors. That will allow us to increase the volumes of gas that can be processed and critically sold via the main gas export pipeline to the customers in Buenos Ayres where we get the highest prices. Now, we think this will take around three months to achieve those compressor upgrades but we’re also going to do it with the intention of minimising the disruption to existing production so we’re going to continue producing and try and optimise things as we go.

Thirdly, there’s going to be the installation of a new impurity removing facility for our liquids and this will substantially increase the quality of all our blends, enabling us to command a premium price for the product that we produce. Installation and commissioning of these facilities we estimate at the moment to be around four months. To emphasise the importance of that and the value of that impurity removal facility, to give you an example, the difference in the sales price between our lowest quality blends and our highest quality blends can be up to $30 a barrel. Therefore you can see that by improving that, from moving from low quality to high quality, it can have a huge positive commercial impact on the company.

I’d also say, I mentioned some timelines there, we are planning to do these upgrades in parallel, at least some of them, so it’s not going to be one after the other but we’re working to optimise things and do them in parallel.

Q5: Can you give us any more detail then?

A5: Well, specifically on the wells which is obviously a key driver to the whole production increase, what we’re going to do is we’re going to use our existing pulling rig, it’s called the Eagle rig, and field personnel already employed by the Santa Cruz Sur joint venture partners. There’s some work to do to upgrade the rig and this is being programmed and worked through as we speak.

The installation of the additional power generation capacity will actually be the first activity and we expect to start that in the next 10-14 days, once contracts have been signed and the arrangements are in place so we are going to put additional generation capacity in three of our five wells.

Again, once all the wells are aligned and the power generation and compressor infrastructure upgrades been completed, we expect production increases net Echo Energy of 40%, which is approximately 600 barrels of oil equivalent day and we’ll do that by the end of the six-month period.

Q6: How much will this cost?

A6: So, this is something we’ve been very focused on and we only wanted to bring it to the market once all the partners had agreed and we could really cost it out so it’s been a big, big piece of work to get to here.

Net to Echo, we expect the delivery of these activities to cost just below $1.5 million with the expenditure spread over six month period and that’s $1.5 million of CapEx so for example, the impurity removal facilities are expected to cost net to the company 70% around $400,000.

Importantly, notwithstanding our existing Santa Cruz Sur joint venture creditor balance, some of them we’ve been very focused in keeping the market updated on, the partners view is the currently we think that we can fund a significant portion of this cost from existing, and of course soon to be increased cash flows and revenues from the assets themselves.

Again, this is something we’ve talked about a little bit before, but by significantly increasing production and revenues, we really drive a virtuous circle of cash flow that improves the production performance and allows us to be more flexible going forward with a stronger financial position.

Q7: Finally, what can you tell us about other opportunities in Echo Energy’s portfolio? Where did they sit?

A7: Our immediate strategy is very much to deliver organic growth from Santa Cruz Sur assets and the plan that we’ve announced today does this from the existing well stock, it doesn’t require new wells, it’s just our existing well stock. However, across our portfolio, we’ve got many other opportunities across the risk reward spectrum which is a great position for us to be in. With the additional cash flows which we’re going to deliver from this plan that we announced today, I will again enable us to broaden the scope of choices that we can make in bringing additional reserves and resources into production, reserves and resources that already exist and we know about and we want to bring them into production as quickly as possible.

Our focus today is very much on the plan that we’ve announced. So, again, the plan doesn’t include the well workovers that we’ve talked about before, they remain out there as future opportunities so an additional to that.

Of course, we’re also working very hard on other opportunities in our portfolio. We’ve talked about the new gas developments potential at Monte Aymond and also, when we have the cash flow, the successful testing of the Campo Limite well. They sit out there into two clear opportunities for us in the future.

We work very closely with our partners and we’re looking forward to doing that and updating the market as we go and delivering this very clear plan that we’ve got in place and that we’ve announced today.