Nanoco Group PLC (LON:NANO) Chief Executive Officer Michael Edelman caught up with DirectorsTalk for an exclusive interview to discuss their interim results, details of the contracts announced, progress in display, funding the business and what to look out for the rest of the year.

Q1: In your recent announcement, you commented about significant progress in the first half of your financial year, can you talk about the key operational and financial highlights?

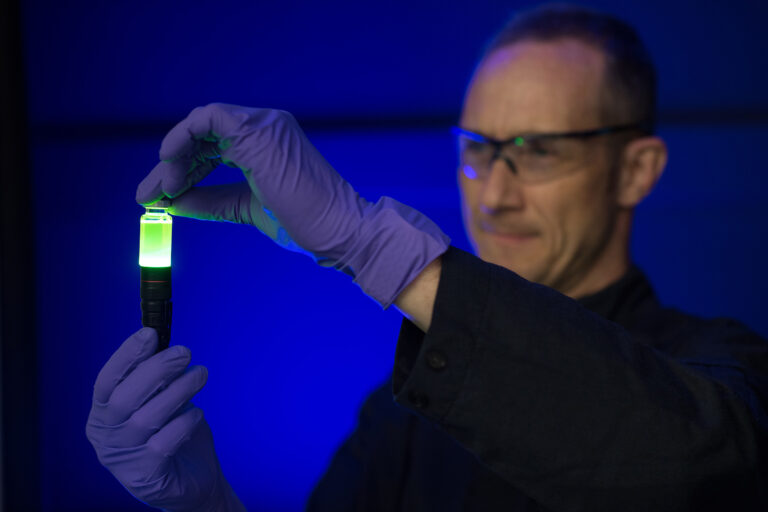

A1: We delivered all of our 2018 milestones under the original agreement with our US customer, part of that was expanding our Runcorn facility which we have done. We signed a significant follow-on agreement with the same US customer covering the commissioning of the new Runcorn facility and validating the product produced there. We’ve also enhanced our performance of our quantum dots for display.

We’ve finished the period with £6.2 million in cash and we have an order book of £8.2 million which for the first time in company’s history we’re able to share that we have visibility going forward.

Q2: Can you explain for us the key details of the various contracts that you’ve announced over the past 14 months with the new US customer and the value of those to Nanoco Group?

A2: Last year, in February 2018, we signed an overarching agreement which governs the rules of how our two companies work together, everything from payment terms, pricing and how IP flows. Underneath that overarching agreement, we hang different workstreams and there are two active workstreams.

Stream one covers the scale up of a specific quantum dot and the built out of our Runcorn facility, that was worth approximately £8 million in 2018. Earlier this year, 2019, we signed an extension to stream one, which is also worth approximately £8 million, and goes on through the end so cover the full calendar year. It’s focussed on getting Runcorn production fully validated and ready to go by the end of 2019 and what that means is ensuring that the material we produce in our Runcorn manufacturing facility matches what we’ve been producing, what’s validated, that comes out of our pilot plant in Manchester.

Moving on to workstream two, this involves a whole new generation of quantum dots for use well out in the future.

So, those are the two key workstreams underneath this overarching agreement.

Q3: Now, progress in display so far has been slow, how is your strategy evolving to address this with regards to your own R&D and manufacturing and you licensees Dow and Merck?

A3: What we’ve done is over the last 6 month period, we’ve dedicated additional resource to improving the performance of our cadmium-free quantum dots for display and this has been successful. We are now sampling customers with new generations of material, new generation of quantum dots, the performance of which are really world-leading so we’re excited about that.

Additionally, we’ve refocussed our business development efforts on working with leading companies who are supplying film resin ink and photo-resist solutions for the display industry so rather than solely working with the OEM’s, the panel makers themselves, working with the folks are delivering product to the OEM’s. So, these are companies that are able to incorporate our quantum dots into various systems, I would call them integrators as they are integrating our quantum dots into resin and film to supply directly to the panel makers and that is proving successful.

Our relationship with DowDuPont, so Dow as move forward they’ve merged with DuPont and then split off again, the division that we work with will be called DuPont going forward, we’ll call them DowDuPont now, I suspect the next time we talk we’ll be calling them DuPont.

Merck remains strong and active, we continue to work on different programmes with both those companies.

Q4: Whilst you remain unprofitable ahead of a commercial order from your US customer, how do you expect to fund the business over the coming year?

A4: Pleasingly, you’ll note in the financial highlights that our loss has narrowed so we’ll losing less money and as I mentioned earlier, we finished the year with £6.2 million in the bank. For the first time in our history, we’ve been able to forecast and look forward and I’m pleased to say that I look towards the end of our calendar year, by the end of December, we’ll also have above £6 million in the bank.

So, we’re running largely cash neutral now, we’re spending somewhere between £800,000-900,000 a month on the total organisation so you can see the level of cash coming, the level of cash going out in a very transparent fashion.

So, as I mentioned, this is the first time we’ve been able to forecast, we have a strong orderbook with about £8.2 million of orders on the system to be delivered but with all of this, we continue to manage our costs really closely.

What we don’t know is when, for example, large PO’s will start to come in from our US customer, when they’re going to start incorporating this into product.

What we do know is we have to be ready and the supply chain has to be ready by the end of 2019 and we’re doing our bit as is the rest of the supply chain, we will be ready.

Q5: What should we look out for over the rest of the year from Nanoco Group?

A5: Continued delivery. So, continued delivery of our obligations opposite the US customer and that really involves getting Runcorn fully validated for commercial supply, we’ve worked closely with other player in the supply chain and making sure that’s ready to go.

Outside of that, in the display industry, we’re very actively engaged in acquiring new partnerships and new customers and I’d hope you’d see some news flow in that area.

So, we’re very bullish, we’re very optimistic and we’re excited to be delivering and working with the great customers we’re working with.