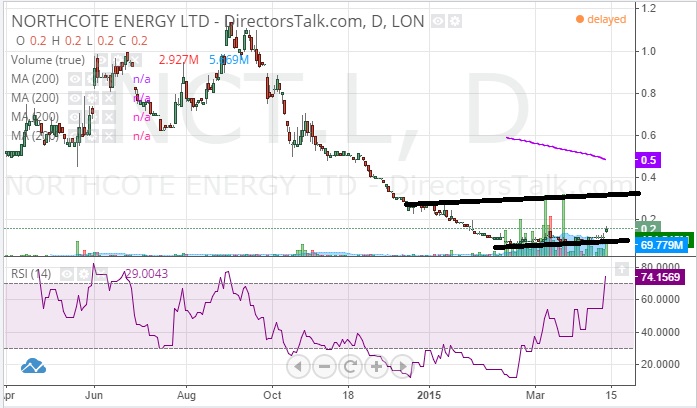

Northcote Energy ltd LON:NCT has not been the happiest of charting situations in the recent past, with the topping out in September followed by the loss of the 200 day moving average the following month. Things were then sealed as being on a negative tack with the 50 day / 200 day moving average dead cross sell stock sell signal. This certainly did its work for the bears in the sense that the stock declined from 0.5p to below 0.1p at worst to start this year.

What can be said since then is that the key event in terms of the revival of the shares was the recovery of the 50 day moving average at the beginning of April. The fact that this clearance has been so clean, without the need for a retest of the feature of support suggests that we are looking at a promising recovery situation. This is especially so given the clearance this week on an end of day close basis of the March intraday peak / neckline resistance at 0.15p. The longer the shares in Northcote Energy Ltd LON:NCT can remain above this old peak, the greater the prospect of an acceleration to the upside, helped along by the recent sharp recovery in trading volume. The view now is that provided there is no weekly close back below the 50 day line / December price channel floor, a top of December price channel target as high as 0.3p could be on the cards over the next 1-2 months.