TEAM Asset Management is a Jersey-based independent asset management company of AIM-listed parent, TEAM plc (LON:TEAM).

Very few investors will look back at 2022 with any fondness but are there grounds to be more hopeful in the year ahead?

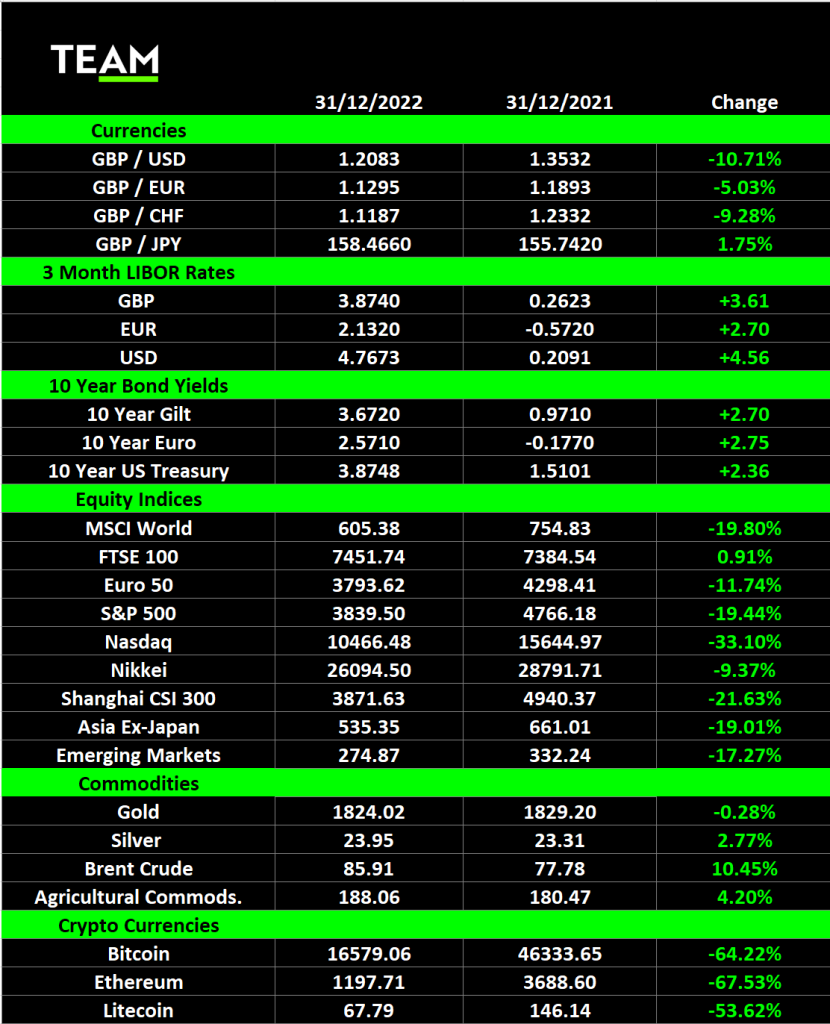

2022 was characterised by escalating geopolitical risk and central banks raising interest rates aggressively to try to tame runaway inflation. Both weighed heavily on investor sentiment, triggering bouts of volatility and deep falls for stocks and bonds. Global stocks declined 19% and UK government bonds fell 25%. Growth and technology stocks suffered even more and the Nasdaq lost 33%.

Heading into 2023, these are all still clear and present concerns for investors. There are no signs of a ceasefire in Ukraine, Taiwan has extended its compulsory military service amid growing tensions with China and central banks will hike interest rates further to bring down inflation.

Against this backdrop, the economic outlook for the year ahead is pretty bleak. Interest rate hikes take time to take effect and will slow economic activity further. Futures markets are pricing in the Bank of England increasing interest rates to 4.75% by this summer and the US Federal Reserve to get to 5% earlier in the year. Recessions in the UK and Eurozone are inevitable and the US economy will also likely contract in 2023. The US government bond yield curve has already inverted, typically a harbinger of recession.

Recessions mean job losses. Companies including Amazon, Goldman Sachs and Twitter have already revealed plans to lay off thousands of workers. Even those in work are also feeling the pinch from inflation and higher borrowing costs. Savings built up during the Covid lockdowns have been exhausted and spending on discretionary consumer goods and services, including holidays, eating out, entertainment and big-ticket items, will be lower.

This will hit corporate earnings and many companies will have less pricing power to pass on higher input costs, putting pressure on margins. However, markets are forward looking and the deep drawdowns experienced this year reflect that investors are already pricing in recession. The blue-chip S&P 500 index fell 19% in 2022, bringing down its price earnings ratio from 26 at the start of the year to 18. Stock valuations are much cheaper than they have been.

At the same time it is difficult to see a meaningful recovery until there is more visibility on when central banks will stop hiking interest rates. For this to happen, we will need to see more evidence of slowing inflation and weaker economic activity, especially higher unemployment. Somewhat counterintuitively, markets will likely rally on any weak economic data reports in anticipation that they will bring forward the end of the interest rate hiking cycle.

Until then we prefer to invest in good quality companies with more dependable profits and cash flow. Companies with strong balance sheets and pricing power should outperform. Many of these companies will be found in the healthcare and consumer staples sectors. When there is some visibility on when central banks will pivot, it should provide a better opportunity to rotate into technology and growth stocks.

Emerging market equities have underperformed developed markets for two straight years on the back of the surging US Dollar, China’s zero-Covid policy and risk aversion across asset classes. However, any stabilisation, or depreciation, of the Dollar, China’s re-opening and a widening economic growth gap over developed markets should provide some tailwinds for emerging markets in 2023.

After a tumultuous 2022, we also expect a rebound in bond markets as economic activity and inflation slow in 2023. Government and investment grade corporate bond yields are the highest they have been more than a decade and they can regain their status as a safe haven asset in portfolios. We prefer to own good quality investment grade corporate bonds which provide an attractive yield above government bonds. The average GBP investment grade corporate bond now yields 5.75% compared to just 2% at the start of last year.

Top of the list of asset classes we will avoid is property. Higher borrowing costs and the squeeze on incomes will have a big impact on affordability and we expect to see a correction in house prices. The outlook for commercial property looks even more challenging. In addition to the headwinds of higher interest rates, a recession will claim many casualties, especially in cyclical sectors such as retail and hospitality, leaving more premises vacant.

TEAM plc (LON: TEAM) is building a new wealth, asset management and complementary financial services group. With a focus on the UK, Crown Dependencies and International Finance Centres, the strategy is to build local businesses of scale around TEAM’s core skill of providing investment management services. Growth will be achieved via targeted and opportunistic acquisitions, through team and individual hires, through collaboration with suitable partners, and organic growth and expansion. TEAM Asset Management is a Jersey-based independent asset management company of AIM-listed parent, TEAM plc.