KEFI Gold and Copper plc (LON:KEFI), the gold exploration and development company with projects in the Federal Democratic Republic of Ethiopia and the Kingdom of Saudi Arabia, has provided an update following the Company’s announcement on 21 November 2022 in which we reported that the finance plan for the c.US$320 million financing of the Tulu Kapi Gold Project had been agreed in principle by the lenders so that draft definitive agreements could be finalised for approval by syndicate members and regulators.

We are now pleased to report that all lead contracting and equity investment parties have agreed their draft agreements and confirmed their intention to sign. Likewise for nearly all Government agencies which have to also sign agreements within the syndicate.

For their part, the lenders have re-affirmed the financing plan in principle and have formally set out their indicative terms and conditions which include, as expected, satisfaction by all parties of their respective conditions and the receipt of all the necessary remaining Ethiopian Government (“Government”) approvals. To this end, during the last months of 2022 the various relevant regulatory agencies were advised of the specific conditions and clarifications required from them in order that progress can be made with the financing and definitive documentation signed.

Whilst the Government is clarifying the outstanding regulatory matters, it is also reorganising its systems around the Project, including for upgraded security and for preparing the community for resettlement.

Following the completion of these steps, and the receipt of final credit committee approval by the lenders, KEFI will call a General Meeting of KEFI shareholders to seek formal shareholder approval of the transaction, in particular any convertibility rights (into KEFI shares) embedded in the financings at the KME level by regional investors as previously outlined.

The Company expects all outstanding issues to be addressed imminently, the exact timing of which will largely be driven by the Government process, so that final lender documentation can be completed, and signing can take place, enabling the KEFI General Meeting to be called, funds to flow and full Project launch to proceed.

The Company and the full syndicate remain focused on achieving full Project launch as soon as practicable. KEFI remains focused on achieving full production from the open pit operations in 2025 and from the combined open pit-underground operation a few years later for combined gold exports of near 200,000 oz per annum (KEFI beneficial interest 80% or near 160,000 oz per annum).

The Company is pleased to provide more details of the key syndicate members as follows:

| Contractors, all of whom have completed updated detailed pricing and scheduling: | |

| · | Process plant construction – Lycopodium |

| · | Mining Services – PW Mining, recently appointed after the re-tendering of the contract in light of recent global cost-inflation |

| · | Electricity supply and maintenance – Ethiopian Electric Power Company |

| · | New access road – Ethiopian Roads Authority |

| Debt Finance (US$190 million), including both senior and mezzanine-offtake-linked subordinated loans: | |

| · | Eastern and Southern African Trade and Development Bank (“TDB”); and |

| · | Africa Finance Corporation (“AFC”) |

| Equity Finance (US$130 million, in addition to historic investment of US$80 million): | |

| · | Subscribers to new share issues by Tulu Kapi Gold Mines Share Company (“TKGM”): |

| · | Government: Ethiopian Ministry of Finance; Oromia Regional Government |

| · | Ethiopian Private Sector: Whilst this financial arrangement is small in quantum it ranks as very significant for aligning corporate and community interests and agendas |

| · | KEFI’s wholly owned subsidiary KEFI Minerals (Ethiopia) Limited (“KME”) which is the primary sponsor having provided all historic funding and assembled all the development finance |

| · | Regional Private Equity Financiers of KME, other than KEFI itself: |

| · | Subscribers to KME Redeemable or Convertible (at KEFI’s election) Loan – subsidiaries of several major international groups. None of these parties is intended to have any involvement in the Project at an operational level, but all have a longstanding presence in, and support of the region |

Commenting, KEFI senior management said:

Finance Director, John Leach:

“It is very pleasing that we are finalising the US$320 million financing of the Tulu Kapi Gold Project. This is a large complex transaction in a challenging working environment, against a backdrop of turbulent equity markets and progressive political reforms in Ethiopia. KEFI is therefore delighted with the first-class syndicate we have established to make the long-standing Tulu Kapi Gold Project an operational reality.

“Our Tulu Kapi financing package is predominately at the Project or subsidiary level. This is also as planned for our Saudi project developments, the first of which, Jibal Qutman Gold, is smaller than Tulu Kapi and now expected to start construction around the end of 2023 and the second of which, Hawiah Copper-Gold, is bigger than Tulu Kapi and expected to start construction after production has commenced at Tulu Kapi and Jibal Qutman.”

Chief Operating Officer, Eddy Solbrandt: “We have already launched key initial aspects of the Tulu Kapi Project development and intend to continue our staged build up to full launch in full collaboration and support of all key stakeholders. In Saudi Arabia during 2023 we focus on the Definitive Feasibility Study and project financing for Jibal Qutman, the Pre-Feasibility Study for Hawiah and the regional exploration programme.

“KEFI’s first eight years after the IPO was prospecting which led to, since 2013, our assembly of five million ounces of JORC resources. In KEFI’s second eight years, we collaboratively assisted to unclog in-country obstacles that held back mining for all, and we assembled our finance. In a few years we expect to be a significant gold producer and, shortly thereafter, also copper.”

Executive Chairman, Harry Anagnostaras-Adams: “The Board is very proud of the teams in Ethiopia and in Saudi Arabia. It has taken a huge effort over a much longer period than we had anticipated in both countries to deal with innumerable frontier market (for mining) challenges and we greatly appreciate the patience and support of all stakeholders and, in particular, of our host governments and communities, our partners and of course our financiers and shareholders.

“Ethiopia’s first modern mining development will include our large Tulu Kapi project which today would be the largest single export-generator for the country. We are looking forward to working with the newly appointed Minister for Mines, H.E. Habtamu Tegegn who was already supporting the project from his previous role as head of the Ethiopian Roads Authority.

“In the Kingdom of Saudi Arabia, after some fourteen years of patient ground-work, the rate of our progress there has taken off at a remarkable pace – with our two advanced projects being at the forefront of ambitious minerals development plans in that country which are being vigorously supported by the Government locally and have been just recently recognised internationally.”

Additional Information on the Tulu Kapi Gold Project

Final Steps to Financial Close

As with any project financings, standard conditions precedent and subsequent must be satisfied (before and after) the signing of definitive agreements by all parties, including but not limited to there being no material adverse change in markets, completion/registration of all documents with the various government agencies, opening international project bank accounts (in Ethiopia requiring collaboration with the National Bank of Ethiopia), placing insurances internationally (in Ethiopia requiring local agents), registering loan-security, receiving confirmations of tenure for mining and for exploration and the lenders’ independent experts’ confirmation that security, community and environmental conditions on the ground are conducive to the planned operations and compliant with IFC World Bank Performance Standards (which in Ethiopia involves significantly upgraded security and community compensation processes in the field).

Such conditions are normal for all mining project finance transactions regardless of commodity, country or company. Tulu Kapi was designed with our Government partners as a show-case project per the latest international standards. All syndicate members are leaders in their field and naturally require completion of due process.

The remaining Government regulatory steps comprise commitments and clarifications as follows, which are required for the definitive agreements to be signed:

| · Ethiopian Ministry of Finance and National Bank of Ethiopia (central bank) confirmations so that finance agreement details provide the same protections for both banks and comply with international practice for mining project finance; and |

| · Ethiopian Ministry of Mines completion of endorsement of historical investment, confirmation of tenure for production and exploration, and direct agreements with lenders. |

It should be noted that the huge effort over the past few years by the Ethiopian Government and its agencies has resulted in only very few regulatory actions and clarifications now remaining, which are being addressed. We greatly appreciate this intense effort which has involved extensive local and international consultations, policy revisions and many other steps taken to facilitate the development of a modern mining sector in the country. KEFI believes there are no grounds to think all clearances and assurances will not be received.

Uses and Sources of Funds

(excludes mining fleet and historic investment)

| SOURCES | ||

| US$ m | £ m | |

| Debt (Senior and Subordinated) | 190 | 165 |

| Equity | ||

| Government and private local | 28 | 24 |

| KEFI | 102 | 89 |

| Total | 320 | 278 |

| KEFI Sources | ||

| Regional Private Equity | c.85 | c.74 |

| Cash Refunds and Public Equity | c.17 | c.15 |

| 102 | 89 | |

| USES | ||

| Item | US$ m | £ m |

| Mining | 36 | 31 |

| Processing plant | 161 | 140 |

| Infrastructure | 20 | 17 |

| Bulk Earthworks | 15 | 13 |

| Social and Environment | 28 | 24 |

| Owners’ Costs, including Working Capital | 35 | 30 |

| Finance Costs | 25 | 22 |

| 320 | 278 | |

| Development Costs, to be spent | 320 | 278 |

| Pre-Development Costs, already spent | 80 | 70 |

| Total Costs | 400 | 348 |

Notes to planned sources and uses:

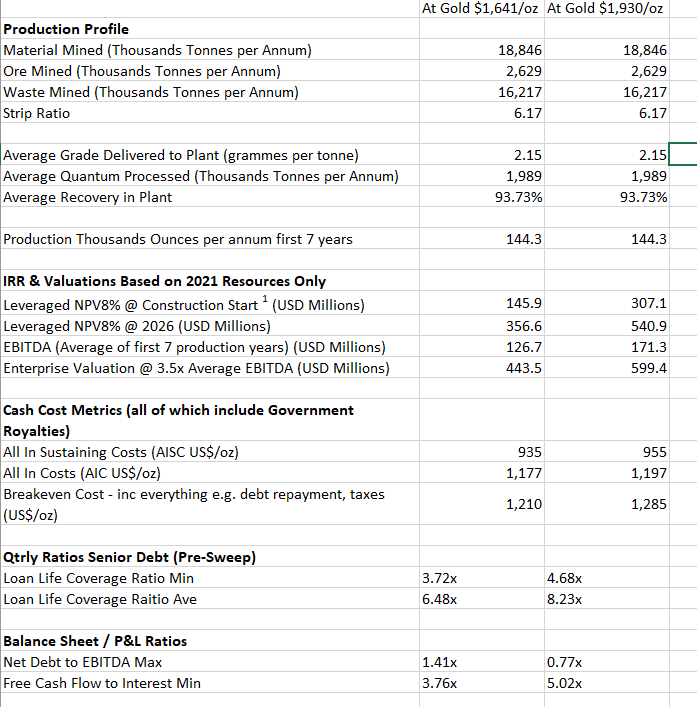

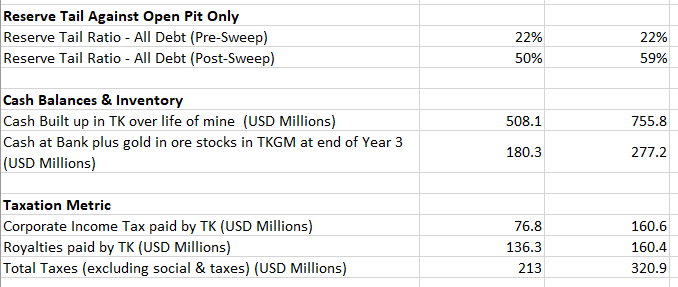

· The Tulu Kapi Project financing has been designed by KEFI to ensure that all net operating cash flow from the open pit only, at a flat break-even gold price of c.US$1,200/oz, is sufficient to fully service debt finance, which is provided pari passu by the lenders. This break-even gold price was selected because market prices exceeded that level for 87% of the past decade, it is approximately US$730/oz or 38% below the current spot price of c.US$1,930/oz, is US$450/oz or 27% below analysts’ long term consensus forecast (CIBC Global Mining Group Analyst Consensus Long Term Commodity Price Forecasts 1 December 2022) of US$1,641/oz, and because it approximates the global average industry All-In-Sustaining-Costs (which is operating costs only and less than All-In-Costs including financing charges).

· Debt has a tenor of seven years (comprising two years’ grace period during construction followed by five production years), is priced at a commercial margin over SOFR (Secured Overnight Funding Rate), is protected by ‘Debt Service Reserve Accounts’ and a cash flow sweep mechanism to expedite its repayment if cash flows permit.

· Equity issues (percentage ownership) at TKGM are based on the relative proportion of total capital provided by each share subscriber, calculated in Ethiopian Birr at the time of the investment. Total TKGM subscribed capital will end up at approximately US$210 million after taking into account all actual pre-development and projected development expenditure, other than c.US$12 million which may be left remaining owing to KEFI. On this basis (after taking into account the Government’s 5% free carried interest) KEFI now expects to own approximately 80% of TKGM.

· The Redeemable Convertible Loans issued by KEFI’s wholly owned subsidiary KME may, at KEFI’s election, be repaid or converted into KEFI shares at average stock market prices from 2026 onwards. Either way the dilution impact for KEFI shareholders is preferred to the alternative of raising public equity at today’s KEFI share price. The corporations which are assembled for this form of investment are large international groups with experience in Ethiopia, who see this as an opportunity to deploy their investable local funds into a well-structured internationally gold-backed project designed to the latest international standards, managed by the first-tier team assembled by KEFI and which supports Ethiopia’s priorities for economic development.

· TKGM owes KEFI c.US$12 million via KME due to historic advances by KEFI. At the signing of the definitive agreements KEFI will, with its Syndicate partners, determine whether it be repaid by TKGM in cash or converted to TKGM shares, as the residual equity requirement for the project financing will then be clear. All Project equity will need to have been subscribed prior to debt drawdown in 2024. KEFI’s top-up of the equity contributions arranged via KME is designed to be covered by the exercise of outstanding warrants in KEFI.

1 Excludes Saudi.

Notes:

Planned Tulu Kapi Project summary economics.

Please note that some of these statistics have improved since they were last published due to the 2023 Mine Plan integration of some underground production and the increased KEFI planned beneficial interest, in addition to some exchange rate movement. The per share statistics are based on Tulu Kapi only (Saudi assets excluded from this Ethiopia-focused analysis) and KEFI fully-diluted shares in issue as at 31 December 2022 of 5,034 million.

| · | At the December 2022 average long-term consensus gold price of US$1,641/oz, KEFI’s beneficial interest in: |

| o | After-debt NPV at start of construction is US$118 million (£99 million or 2.0 pence per share) and in 2026 after start of production is US$288 million (£242 million or 4.8 pence per share) |

| o | EBITDA average for first 7 production years is US$103 million (£86 million or 1.7 pence per share) |

| · | At current gold spot price of c. US$1,930/oz, KEFI’s beneficial interest in: |

| o | After-debt NPV at start of construction is US$247 million (£208 million or 4.2 pence per share) and in 2026 after start of production is US$435 million (£366 million or 7.3 pence per share) |

| o | EBITDA average for first 7 production years is US$137 million (£119 million or 2.4 pence per share) |

· The 2023 Mine plan, as summarised herein assumes:

o mining of ore is at the rate of 2,629,000 tonnes per annum

o processing is at the rate of 1,989,000 tonnes per annum which is the warranted design nameplate

o as regards the ore available for mining. there is some upside potential because it is expected that:

– in-fill drilling during plant construction will increase Mineral Resource and Ore Reserve of the open pit by including mineralisation which is already identified but not yet drilled to sufficient density for inclusion in Resources

– the underground mine feasibility study to be completed during plant construction will demonstrate the feasibility of extracting more than the assumed c. 200,000 ounces from underground resource of c. 600,000 ounces

o as regards the processing rate, it is expected that there is potential flexibility around the assumed rate which is based simply on contractually warranted minimum design-capacity. Minor capital expenditure during production could allow :

– a 10-15% per annum higher processing rate

– a reduced rate in later years if desired in order to extend mine life for smaller throughput rates after depleting the open pit, by mining from underground or potential satellite pits