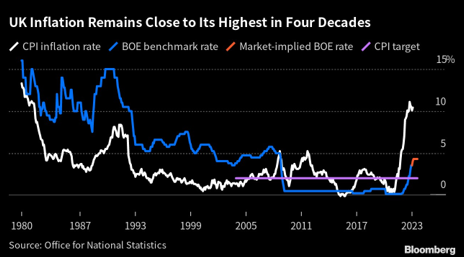

A hot UK inflation print this morning has jolted markets, triggering a swift repricing of the odds of an interest rate hike at tomorrow’s Monetary Policy Committee (MPC) meeting.

The Consumer Prices Index (CPI) unexpectedly accelerated to 10.4% YoY in February from 10.1% YoY the previous month, surpassing all economists’ forecasts who had projected a return to single digits.

- Food and non-alcoholic drink prices soared at 18% YoY, the fastest pace since 1977.

- Clothing and footwear rose 8.1% YoY.

Of greater concern for policymakers will be the breadth of price rises.

Core inflation, excluding volatile food and energy prices, reaccelerated to 6.2% YoY from 5.8% in January.

Services inflation, a measure watched carefully by the Bank of England for signs of potential wage pressures, jumped to 6.6% YoY from 6% YoY in January.

Odds of a 25-basis point increase tomorrow have moved from a coin-flip (50/50%) last night to near- certainty (96%) at the time of writing:

This latest data dump renders Britain the sole Group of Seven nation with inflation stuck at double-digit levels, and with growth also acutely below pre-pandemic trend.

The MPC’s balancing act between weighing acute and persistent price pressures against the squeeze being felt by businesses and households has just become more precarious.

TEAM plc (LON:TEAM) is building a new wealth, asset management and complementary financial services group. With a focus on the UK, Crown Dependencies and International Finance Centres, the strategy is to build local businesses of scale around TEAM’s core skill of providing investment management services.