Despite enjoying a flood of investment in July, the level of new funds finding their way into AIM’s Oil & Gas Exploration & Production sector slowed to a trickle in August and September; nevertheless, there are reasons to be optimistic, with the AIM Oil & Gas Index’s responding positively to higher oil prices and clawing back over half the losses it made between the end of 2016 and 11th August 2017.

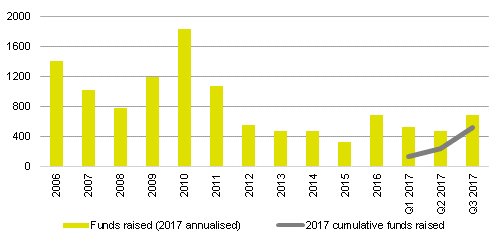

Despite Hurricane Energy plc (LON:HUR) raising £238 million in July to help pay for an early production system West of Shetland, the total amount of money raised by AIM-listed oil and gas exploration and production companies in the third quarter 2017 was £55 million less than in the corresponding period a year earlier. On a more positive note, the total invested in the sector for the first 9 months of 2017 was still £3 million ahead of the first 9 months of 2016. Nonetheless, given the lack of momentum in August and September, it is by no means clear that there will be an improvement for the year as a whole. Even though the sector benefited from the price of a barrel of Brent crude increasing by 50% to US$57 in 2016 while it has declined slightly to US$54 so far this year, that would be disappointing.

Despite the lack of investment in AIM-listed oil and gas companies, there are indications that the sector’s outlook is improving. The International Energy Agency has indicated that demand is growing a bit faster than previously thought while the North American drilling rig count has declined slightly in recent weeks. This seems to have resulted in an improvement in sentiment and has enabled the sector to claw back over half of the 20% decline it recorded between the end of 2016 and 11th August 2017