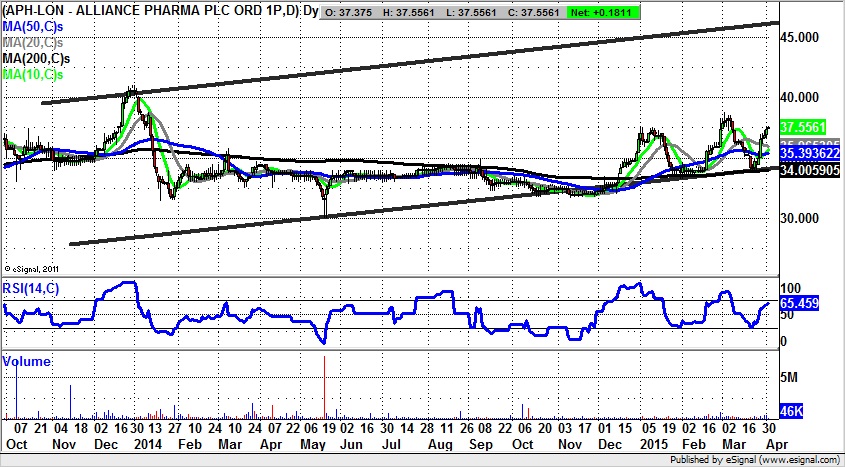

Alliance Pharma (LON:APH) is currently sporting a daily chart which inspired technical confidence, if nothing else. This is because over the initial part of 2015 we have been treated to an extended double bounce off the 200 day moving average now at 33.98p. There is also the backing of a wide rising trend channel which can be drawn from the beginning of 2014p, one which has its base effectively at the 200 day line level. All of this goes to suggest that much of the heavy lifting with regard to the shares putting in an extended floor prior to a fresh sustained journey to the upside.

Just how high this could stretch is currently suggested by the resistance line projection of last year which is pointing as high as 45p plus. This is a destination that one would expect to be hit as soon as the next 1-2 months, especially while the 50 day moving average now at 35.33p remains in place as support. Indeed, it can be said that while there is no end of day close back below the 50 day line the stock should start to accelerate to the upside. Only cautious traders would wait on a clearance of early 2015 resistance at 38p before taking the plunge on the long side.