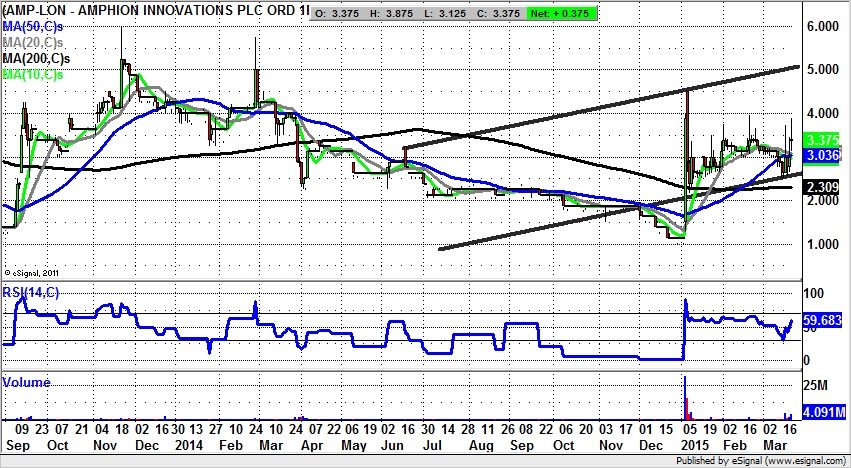

It would appear that shares of Amphion Innovations are making a second serious attempt at changing trend to the upside, after first clearance of the 200 day moving average now at 2.3p faded this time last year. The reason for optimism now on a technical perspective is the way that we have sustained the January break of the 200 day line in the aftermath of an as yet unfilled gap to the upside which kick started the latest recovery. The position now is that following significantly higher support coming in for March above the 200 day moving average and former July – September resistance towards 2.25p, we are looking at a very constructive pattern.

Indeed, the expectation over the next 1-2 months is for progress towards the top of a rising trend channel from June last year. This has its resistance line projection currently heading as high as 5p plus, with such a scenario leading to a retest of the main 2013 – 2014 resistance zone in the 5p – 6p zone. At this stage the favoured charting strategy is that any weakness towards the 50 day moving average should be regarded as a buy opportunity, with only a weekly close back below the 200 day line suggesting another bear period is on its way.