Baron Oil Plc (LON:BOIL), the AIM-quoted oil and gas exploration and appraisal company, has announced that a copy of a Competent Person’s Report (CPR) prepared by the RPS Group on Dunrobin for Licence Administrator Reabold Resources Plc on behalf of the Joint Venture, in which Baron has a 32% non-operated working interest, can be viewed here:

The Dunrobin licence is situated in the Inner Moray Firth.

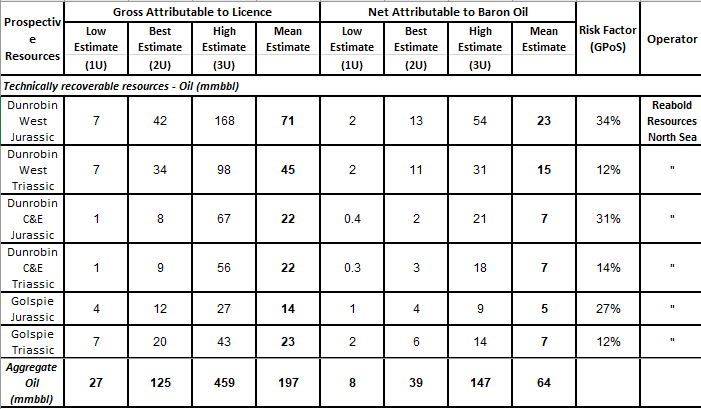

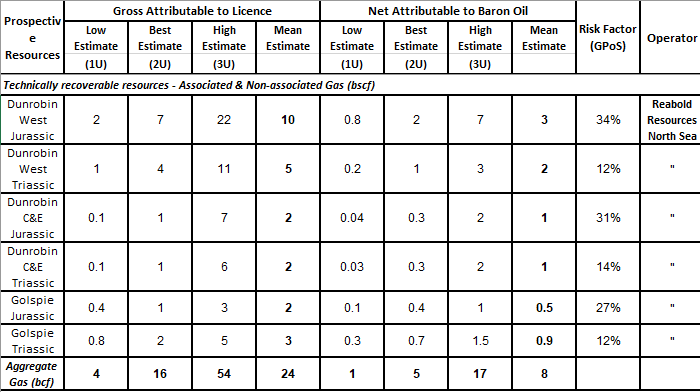

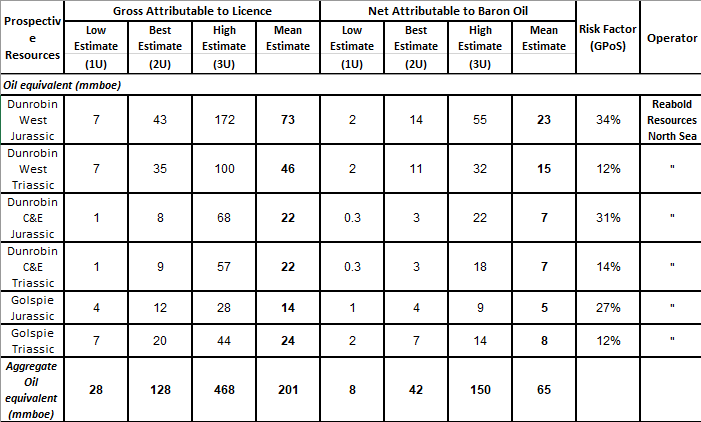

The CPR has been prepared in accordance with the June 2018 Petroleum Resources Management System as the standard for reporting. A summary of the gross and net Prospective Resources is given in the table below.

Key Points from the CPR

· 201 mmboe1 aggregate2 gross unrisked Pmean Prospective Resources on licence P2478

· The Dunrobin West prospect (“Dunrobin West”) estimated to contain 119mmboe gross unrisked Pmean Prospective Resources aggregated across the Jurassic and Triassic stacked targets3

· 34% Geological Probability of Success (Pg) at Dunrobin West Jurassic primary target with an estimated 71mmbbl (gross) of Pmean Prospective Resources

· Seismic response at the Jurassic target at Dunrobin West interpreted to be a possible gas cap and a gas oil contact

· Dunrobin West geologically analogous to the Beatrice field, which produced in excess of 140mmbbl

· Secondary Triassic target included in formal resource assessment for the first time

· The Company has aggregated unrisked net Pmean Prospective Resources in the CPR and estimates Baron’s farm up arrangement of August 2021 has increased the Company’s share of aggregate unrisked net Pmean Prospective Resources on licence P2478 from 30mmboe to 64mmboe at a capped cost to Baron of £160,000

1 The CPR reports oil and gas Prospective Resources. The oil equivalent value of the gas resources has been estimated by the Company using a factor of 1 barrel of oil to 6 thousand cubic feet of gas.

2 The unrisked aggregation was performed by the Company and assumes that all prospects at all levels are successful.

3 The unrisked aggregation of Dunrobin West was performed by the Company. The volumes were presented for each reservoir in the CPR and, at the Company’s request, were not aggregated probabilistically.

Management Commentary

Management estimates, which differ from RPS mainly in their approach to statistical volumetric estimation, for Dunrobin West for the Jurassic alone remain in excess of Pmean 100mmbbl* gross unrisked Prospective Resources. Dunrobin West has been proposed by the JV to be the location of the first exploration well on the licence. Management believes that a single vertical borehole on Dunrobin West to a total depth of c.800 metres can test both Jurassic and Triassic targets at an estimated gross drilling cost of £8.6 million on a dry hole basis. A farmout campaign to attract additional funding is underway.

Jon Ford, Technical Director of Baron commented…

“We are pleased that the CPR provides independent confirmation for the Company’s belief that the western part of the Dunrobin complex has matured into a drillable prospect where a relatively low-cost exploration well can target more than 100 MMbbl* of gross Pmean Prospective Resources with low geological risk. It validates our decision in 2021 to enter into a farm up arrangement which more than doubled our working interest in the licence to a more meaningful 32% by promoting and accelerating the Phase A work programme to a technically high standard at relatively modest cost.

“The publication of the CPR will add impetus and credibility to the ongoing farmout campaign which has already attracted industry interest.”

Technically Recoverable Prospective Resources

The table below summarises RPS’s independent assessment of Gross Prospective Resources as at the CPR’s effective date of 30 September 2022, from which are derived the Net Prospective Resources attributable to Baron’s 32% effective interest, wholly within the P2478 licence areas. Totals are by arithmetic summation.

Notes:

· Company has aggregated P90, P50, P10 and Mean values arithmetically. This is not statistically correct, and may not sum exactly due to rounding factors.

· “Gross Attributable” are 100% of the resources attributable to the licence whilst “Net Attributable” are those attributable to Baron’s effective interest in the licence (32%) before economic limit test.

· Includes a mix of associated gas and non-associated gas from Dunrobin West Gas Cap, all others are associated gas only

· Mean is defined as the arithmetic average of successful outcomes

· Mmboe calculation, using a factor of 1 barrel of oil to 6 thousand cubic feet of gas, has been provided by Baron Oil for reference for the purposes of this announcement. See announcement glossary for basis of calculation

* Not SPE PRMS compliant.