Roland Arnold, Portfolio Manager of the BlackRock Smaller Companies Trust plc (LON:BRSC), explains how he uncovers companies that could grow their earnings for the long term.

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

In the short term, share prices for individual companies may be driven by a variety of unpredictable and erratic factors – from fear, or greed, to investor confidence or fund flows. However, in the longer term, share prices largely follow company earnings. If a company can grow its earnings sustainably over time, this will drive share price performance. Identifying such companies is the simple goal of our investment approach.

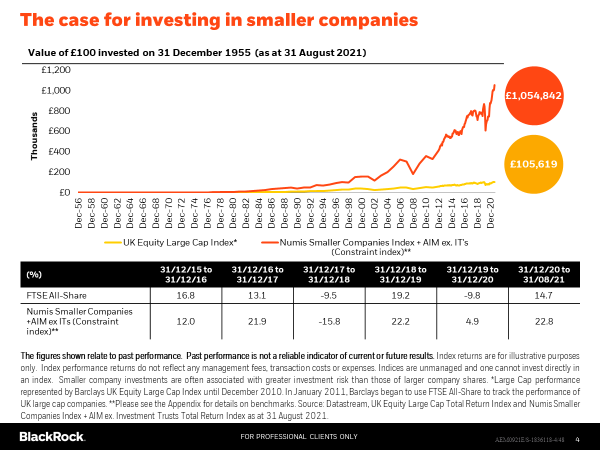

Over the very long term, since 1955, smaller companies have delivered around 4% better return than larger companies. Compounded over many years, this could make a significant difference to an investor’s returns, however, it is worth noting that this is an average. Active managers may deliver a higher return if they get their stock selection right, or a lower return if they don’t.

With this in mind, we focus considerable resources on stock selection. Our bottom-up research process looks to find those companies that can grow their earnings over many years. These are companies that we can buy early in their development, with a goal to hold them through their growth into larger companies. However, please be aware that past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

To learn more about the BlackRock Smaller Companies Trust plc please follow this link: blackrock.com/uk/brsc

Finding growing companies

The 100-120 companies that sit in our portfolio score well on the five key criteria at the heart of our investment process. The first is to assess the quality of the management team, whether they have a track record of delivering on their promises. We also look at the market position for each company – are these businesses capable of leading and shaping their markets long term?

We examine the balance sheets in-depth: this has been particularly relevant over the past year. Do they have the capital to survive through difficult and unusual market conditions? Cash flow is also important. A company needs to have the cash flow to support its organic growth, rather than being forced to keep coming back to shareholders for more capital.

We also look at the track record. History can be a guide to the future. Has a company consistently met or beaten expectations? If it has, it tells us something positive about the management team or the market position or the products.

What sectors do we find appealing?

Where we find these opportunities will change over time. However, our core holdings have remained relatively similar in recent years and through the pandemic. Management teams have rewarded our faith in them during this crisis, responding flexibly and skilfully to a changing world, reshaping their business or strategy where necessary.

The three largest sectors in the portfolio today are media, investment banking/brokerage and consumer services. The media sector suggests a conformity in exposure, however the stocks that sit in the portfolio have a variety of specific drivers, some are geared to reopening, others to structural market shifts. The ‘investment banking/brokerage’ sector is poorly named and doesn’t reflect our exposure, which is focused on are asset managers. We believe the market has further to run as economic recovery builds and this sector is well-placed. This is particularly true for those with expertise in the sustainability sector.

On the consumer services side, there are many businesses in the retail sector that look interesting today. Many have fundamentally shifted their distribution mix during the pandemic, shifting to a multi-channel offering that will endure. Sadly, many retailers haven’t made it through Covid, so the ones that are left are in a much stronger position.

The broader outlook

We see three key themes emerging, which will help guide our stock selection from here. The growth in consumer spending as the economy reopens will be important. Labour shortages are leading to increased pay, whilst furlough and government support have allowed consumers to build considerable savings, which could be very beneficial in boosting the recovery.

The industrial cycle is another area of focus. We see the demand continuing to build with recoveries in manufacturing, automotive and, ultimately, aerospace. We also think companies are re-examining the ‘just-in-time’ model that is commonplace but has been proved to be a very difficult way to manage supply chains in the last two years. Both the US/China trade war and the pandemic exposed the problems with companies not having the stock they need to maintain production. We believe two things are likely to happen: the first is a general industrial recovery, but the second is an inventory restock as companies rethink their supply chains. It will create a leveraged effect for certain industrial companies.

We’re also positive on the UK construction sector. This is seeing strong demand from both the private sector (such as housebuilders), and the public sector (from infrastructure development). This is a sector that has changed in the last few years, with a far better contract environment.

Equally, we are conscious of emerging risks. We continue to consider how inflation or labour shortages may affect our portfolio holdings. However, our focus is on market leading businesses, which have natural pricing power. This can help mitigate against inflationary and competitive forces.

We will keep looking, trying to find more companies that can deliver strong earnings growth in the years ahead. Ultimately, we want to find the strongest 100-120 companies in the UK market. Most of all, we are optimistic from here – we believe in the market recovery.

To learn more about the BlackRock Smaller Companies Trust plc please follow this link: blackrock.com/uk/brsc

Risk Warnings

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

Trust Specific Risks

Liquidity risk: The Trust’s investments may have low liquidity which often causes the value of these investments to be less predictable. In extreme cases, the Trust may not be able to realise the investment at the latest market price or at a price considered fair.

Gearing risk: Investment strategies, such as borrowing, used by the Trust can result in even larger losses suffered when the value of the underlying investments fall.

Smaller companies risk: Smaller company investments are often associated with greater investment risk than those of larger company shares.

Important Information

Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock.

BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. To ensure you understand whether our product is suitable, please read the fund specific risks in the Key Investor Document (KID) which gives more information about the risk profile of the investment. The KID and other documentation are available on the relevant product pages at www.blackrock.co.uk/its. We recommend you seek independent professional advice prior to investing.

This material is marketing material. The Company is managed by BlackRock Fund Managers Limited (BFM) as the AIFM. BFM has delegated certain investment management and other ancillary services to BlackRock Investment Management (UK) Limited. The Company’s shares are traded on the London Stock Exchange and dealing may only be through a member of the Exchange. The Company will not invest more than 15% of its gross assets in other listed investment trusts. SEDOL™ is a trademark of the London Stock Exchange plc and is used under licence.

Net Asset Value (NAV) performance is not the same as share price performance, and shareholders may realise returns that are lower or higher than NAV performance.

The BlackRock Smaller Companies Trust plc currently conducts its affairs so that its securities can be recommended by IFAs to ordinary retail investors in accordance with the Financial Conduct Authority’s rules in relation to non-mainstream investment products and intends to continue to do so for the foreseeable future. The securities are excluded from the Financial Conduct Authority’s restrictions which apply to non-mainstream investment products because they are shares in an investment trust.

Any research in this material has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy.

This material is for information purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock funds and has not been prepared in connection with any such offer.

© 2021 BlackRock, Inc. All Rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, iSHARES, BUILD ON BLACKROCK and SO WHAT DO I DO WITH MY MONEY are trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.

ID: MKTGH1021E/S-1880162