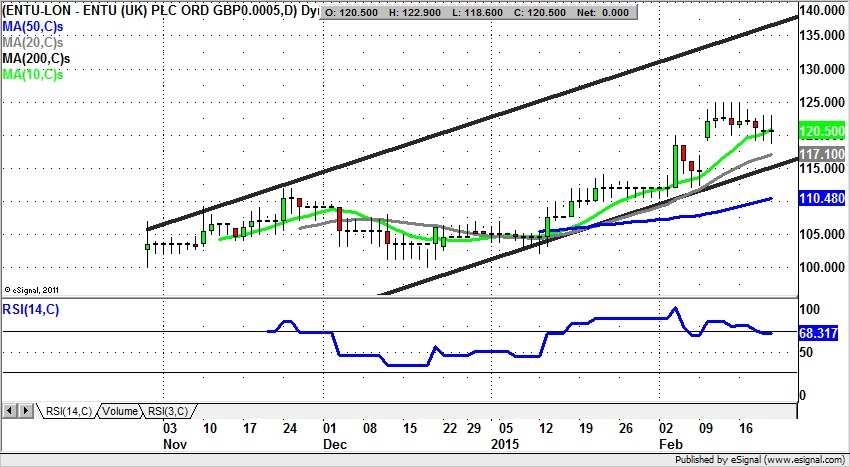

One of the better rules about the process of identifying the better investing / trading opportunities is when there is a strong combination of technical and fundamental factors in alignment. This would certainly appear to be the case at Entu (UK) PLC (LON:ENTU), in terms of the business model based on energy efficiency, and a successful IPO aftermath with a decent initial trend for the shares. The daily chart shows how even in just a few months we have an accelerating progression within a rising trend channel from November. The highlight to start 2015 has been the break above the trend determining 50 day moving average, with the added plus since then being the way that new support has been test for at former resistance. This type of step progression is usually only seen in the strongest of technical situations, of which Entu looks to be a good example. For the near term we have been treated to an as yet unfilled gap to the upside through 117p. The view in the wake of this is that at least while there is no weekly close back below the gap floor of early February we should see a top of late 2014 price channel target as high as 140p over the next 1-2 months. This is despite the way that there have already been significant gains since the stock came to market in the autumn.