KEFI Gold and Copper PLC (LON:KEFI), the gold and copper exploration and development company with projects in the Federal Democratic Republic of Ethiopia and the Kingdom of Saudi Arabia, has announced an upgrade to the Mineral Resource Estimate at the Hawiah Copper-Gold Project, part of the KEFI-operated Saudi Arabian joint-venture Gold and Minerals Company Limited.

Highlights

· Hawiah Mineral Resource Estimate has increased by 4.1 million tonnes (“Mt”) to 29.0 Mt at 0.89% copper, 0.94% zinc, 0.67 g/t gold and 10.1 g/t silver, representing a tonnage increase of 16%. Total contained metal is now:

o 258,000 tonnes of copper (up 16% from 223,000 tonnes);

o 272,000 tonnes of zinc (up 30% from 210,000 tonnes);

o 620,000 ounces of gold (up 25% from 497,000 ounces); and

o 9.4 million ounces of silver (up 20% from 7.8 million ounces).

· Indicated Resource increased to 12.4Mt (up 14% from 10.9Mt), which now includes 1.2Mt of oxide material (previously all Inferred) containing 80,000 ounces of gold.

· Total Indicated and Inferred Resources reporting to the Open-Pit Scenario have increased to 11.1Mt (up 32% from 8.4Mt), reaffirming the potential for an initial open-pit mining operation and a lower start-up capital requirement.

· Drilling commencing in Q2 2023 is aimed at extending planned mine life by further increasing the Hawiah Mineral Resource and converting more Inferred Resources to the Indicated category.

Harry Anagnostaras-Adams, Executive Chairman of KEFI, commented:

“The updated Mineral Resource Estimate for the Hawiah Copper-Gold Project achieved our key objectives: a tonnage increase of approximately 16%, plus a higher overall increase in metal content due to overall improved grades, plus the increase in the Indicated Resource category, plus the increased open pittable component.

“The Hawiah Preliminary Feasibility Study is progressing well and additional drilling during 2023 is being designed to further increase and upgrade the resource.

“KEFI now has a platform of three advanced projects for development in the next few years: the Tulu Kapi Gold Project in Ethiopia which is advancing to full project launch in light of the improvements in the Ethiopian working environment during the past twelve months and for which a formal update will be announced shortly, the now larger Hawiah Copper-Gold project in Saudi Arabia, and the Jibal Qutman Gold project, also in Saudi Arabia.”

Background

Since the commencement of major exploration works at Hawiah in early 2019, KEFI announced a maiden MRE in August 2020 followed by the December 2021 updated MRE of 24.9Mt at a 0.90% copper, 0.85% zinc, 0.62 g/t gold and 9.81 g/t silver.

Diamond and reverse circulation (“RC”) drilling have since continued with an additional 7,675m of diamond drilling and 4,845m of RC drilling completed over the past year, bringing the Project total to 58,194m of drilling. Recent drilling had three main objectives:

– Improve the level of geological control in the upper portion of sparsely explored Central Zone and northern portion of the Camp Lode;

– Explore the Crossroads Extension Lode and further define the deeper portion of the orebody; and

– Better define the upper oxide and transition zones and increase the known gold resource.

These objectives have been achieved and with the deposit remaining open at depth, the Hawiah orebody has additional potential for further enhancement and expansion.

GMCO appointed The MSA Group (Pty) Ltd (“MSA”) as the Independent Consultants and Competent Person to prepare an updated MRE for Hawiah in accordance with the Australasian Code for the Reporting of Exploration Results, Mineral Resources and Ore Reserves (“JORC Code 2012”).

Looking forward to 2023, work programmes including reverse-circulation and diamond drilling are being planned to upgrade the classification of current Inferred Resources to the Indicated category for use in the Hawiah Definitive Feasibility Study (“DFS”). These programmes are designed to run in parallel with the maiden MRE for the nearby Al Godeyer deposit which is being scheduled for Q1 2023.

Updated Hawiah MRE

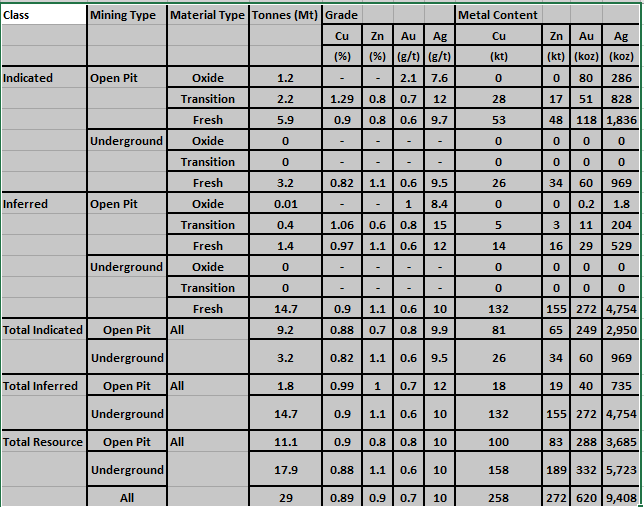

The updated MRE for the Hawiah deposit is detailed in Table 1 below and now totals:

– 29.0 Mt at 0.89% copper, 0.94% zinc, 0.67 g/t gold and 10.1 g/t silver.

Resources are classified as:

– Indicated – Open Pit – 9.2 Mt at 0.88% copper, 0.70% zinc, 0.84 g/t gold and 9.9 g/t silver

– Indicated – Underground – 3.2 Mt at 0.82% copper, 1.07% zinc, 0.59 g/t gold and 9.5 g/t silver

– Inferred – Open Pit – 1.8 Mt at 0.99% copper, 1.02% zinc, 0.67 g/t gold and 12.4 g/t silver

– Inferred – Underground – 14.7 Mt at 0.90% copper, 1.05% zinc, 0.58 g/t gold and 10.1 g/t silver

Based on this MRE, the Hawiah deposit is estimated to contain a total of 258,000 tonnes or 569 million lbs of copper, 272,000 tonnes or 600 million lbs of zinc, 620,000 gold ounces and 9.4 million silver ounces.

Table 1 : MSA Minerals Resource Statement for Hawiah,

Effective Date 12 December 2022 (see notes 1,2,3,4,5,6,7)

Notes on MSA Resource statement:

(1) koz = one thousand ounces, kt = one thousand metric tonnes, Mt = one million metric tonnes.

(2) All tabulated data have been rounded and as a result minor computational errors may occur.

(3) Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability.

(4) The Gross Mineral Resource for the Project is reported.

(5) The Mineral Resource is reported in accordance with the guidelines of the 2012 Edition of The Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (‘the JORC Code’).

(6) A Whittle optimised pit shell was used to report open-pit Mineral Resources and a mineable shape optimisation (MSO) was completed for underground Mineral Resources outside the open-pit shell. The Whittle, MSO and cut-off grades were derived using the following assumed technical parameters:

– No Oxide and Transition mined underground.

– Pit slope angle: Fresh 53%, Transition and Oxide: 42%.

– Dilution included in regularised block model (5 mX by 5 mY by 2.5 mZ) for open-pit

– A minimum stope width of 2 m, and 10% dilution applied for underground.

– Concentrator Recovery: Cu 92%, Zn 76%, Au 74%, 83% Ag in fresh domain and Au 84%, 15% Ag in oxide. No recovery of zinc and copper in oxide. Metallurgical factors based on initial metallurgical test-work.

– Cost and revenue assumptions:

o Metal Price: Cu 9350 USD/t, Zn 3300 USD/t, Au 1820 USD/oz, Ag 26 USD/oz.

o Smelter recovery/payability: Cu concentrate – Cu 95.5%, Au 90%, Ag 90%. Zn concentrate – Zn 84.9%. Au Dore – Au 99.5%, Ag 99.6%.

o Total mining cost: open pit oxide 2.2 USD/t, open pit transition and fresh 2.4 USD/t, underground 30.0 USD/t. Cost adjustment for open-pit depth USD0.004/ vertical m.

o Total Processing cost: oxide 15.4 USD/t, transition and fresh 19.5 USD/t.

o G&A: 5.6 USD/t ore.

(7) A net smelter return (NSR) calculation was carried out by G&M that was reviewed and accepted as reasonable by MSA. The cut-off grade was applied on a NSR basis: underground fresh ore 49.5 USD/t, open-pit transition and fresh ore 21.9 USD/t, open-pit oxide ore 17.6 USD/t. NSR was calculated for each block model cell using the following formulae:

Oxide = (Cu %*0)+(Zn%*0)+(Au g/t 48.8912 )+(Ag g/t*0.1217)

Transition and Fresh = (Cu %*72.6915)+(Zn%*16.4965)+(Au g/t *41.767)+(Ag g/t*0.6579)

Mineral Resource Estimation comparison and future expansion

The updated MRE represents a significant increase in tonnage from 24.9Mt to 29.0Mt, a small decrease in copper grades from 0.90% to 0.89%, with an increase in zinc grades from 0.85% to 0.94% along with an increase in gold and silver grades from 0.62 g/t gold to 0.67 g/t gold and from 9.81 g/t silver to 10.1 g/t silver (Table 2) .

Table 2 – 2021 MRE and Updated MRE comparison – Grade and Tonnage.

| 2021 MRE | Updated MRE | Difference (%) | |

| Tonnage (Mt) | 24.90 | 29.00 | +16% |

| Copper (%) | 0.90 | 0.89 | -1% |

| Zinc (%) | 0.85 | 0.94 | +11% |

| Gold (g/t) | 0.62 | 0.67 | +7% |

| Silver (g/t) | 9.81 | 10.10 | +3% |

The additional resource tonnage is largely driven by:

– increased density of the Oxide Zone from 1.7g/cc to 2.32g/cc;

– expansion of Crossroads Extension Lode at depth; and

– inclusion of a greater portion of the model across all domains due to increased drill density and confidence.

The increase in the Oxide Zone resources from 0.7Mt to 1.2Mt (Inferred to Indicated classification) and contained gold from 35koz to 80koz. This has been due to the increased drilling density within this domain and improved recoveries obtained by switching the sampling method from diamond to reverse circulation drilling. This drilling, running in combination with a deep trenching programme allowed for improved understanding of density characteristics of the oxide domain. The average oxide gold grade has also increased from 1.49g/t to 2.1g/t, representing a 41% increase.

As highlighted in the 2022 MRE, while the limits of the Crossroads Extension contained lower than average copper grade, the zinc, gold and silver grades result in all additional mineralisation defined in this area of the Hawiah deposit reporting to the underground resource estimate. As predicted by the geological model, drilling this year has shown the Crossroads Extension portion of the orebody has a higher average zinc and gold grades with the final and deepest drillhole into this area (HWD 201) intersected 8.8m (estimated true width of 6.2m) at 2.9% zinc and 0.79g/t gold, demonstrating that this high-grade area of the Hawiah deposit remains open at depth.

The early phases of exploration in 2023 will focus on resource classification upgrade drilling throughout the deposit and exploration drilling in deeper areas of the Crossroads Extension. The classification upgrade will then feed into the DFS.

Open-Pit Scenario

GMCO is also pleased to report that the resources reporting to the Open-Pit Scenario have been expanded from the previous 8.4Mt reported in 2021 to a total of 11.1Mt at 0.90% copper 0.75% zinc, 0.81 g/t gold and 10.30 g/t silver (see Figure 2 in Appendix C).

This Hawiah deposit continues to demonstrate a robust case for a lower cost open-pit development during the early years of the Project, further strengthening the economic case. This Open-Pit Scenario will be fully evaluated during the DFS which will include the upgraded oxide resource and the results of the 2023 drilling programmes.