KEFI Gold and Copper (AIM: KEFI), the gold and copper exploration and development company with projects in the Federal Democratic Republic of Ethiopia and the Kingdom of Saudi Arabia, has presented the maiden Mineral Resource Estimate at the Al Godeyer Project, which forms part of the Hawiah Complex, all part of KEFI’s Saudi Arabian joint-venture Gold and Minerals Company Limited.

In Saudi Arabia, the Jibal Qutman Gold Project, the Hawiah Copper-Gold Project and the other Saudi projects are under GMCO (now planned to be 25-30% owned by KEFI). In Ethiopia, the Tulu Kapi Gold Project is under TKGM (now planned to be 70-80% owned by KEFI). Final beneficial ownership will depend on project financing requirements.

Highlights

· Maiden Al Godeyer Inferred Open-Pit Mineral Resource Estimate of 1.35 million tonnes (“Mt”) at 0.6% copper, 0.54% zinc, 1.4g/t gold and 6.6g/t silver potentially complements the Inferred Resources reported for the Open-Pit Scenario at the nearby Hawiah deposit of 11.1Mt, as announced by KEFI on 9 January 2023.

· Al Godyer continues to be open at depth and along strike

· This reaffirms the potential for an initial open-pit mining operation at Hawiah as does early oxide metallurgical testwork which indicates that the Al Godeyer ore can be processed at the Hawiah plant located 12km from the site.

· Drilling planned to commence in Q2 2023 will be aimed at converting unclassified areas of the deposit to the Inferred category and to further test the strike extent of the orebody.

· Concurrent drilling planned at Hawiah will focus on upgrading and further expanding its total resources reported on 9 January 2023 of 29.0 Mt at 0.89% copper, 0.94% zinc, 0.67 g/t gold and 10.1 g/t silver.

Harry Anagnostaras-Adams, Executive Chairman of KEFI, commented:

“This Al Godeyer maiden copper-zinc-gold-silver Mineral Resource has confirmed the clear potential to support the Hawiah project, at this stage lifting to over 12Mt the total tonnage being considered for the Open-Pit Scenario.

“Feedback from the early metallurgical testwork is particularly exciting and demonstrates the amenability of Al Godeyer to provide additional open pit feed material to the proposed Hawiah Complex.

“The work completed at Al Godeyer further demonstrates our ability to discover and rapidly advance projects in our ever-growing exploration portfolio within the Kingdom of Saudi Arabia, with the GMCO team taking the Al Godeyer target from a mineral occurrence to a JORC compliant resource in a little over a year.

“Elsewhere within the Kingdom, the Jibal Qutman project is advancing on schedule with our aim to start construction by the end of 2023. The Hawiah Pre-feasibility Study is currently being finalised and drilling is set to shortly recommence on the Hawiah site. This drilling is primarily focused on converting Inferred Resources to the Indicated category, but is also aiming at extending the planned mine life by further increasing the Hawiah Mineral Resource in a few key areas.

“KEFI has very exciting growth prospects in both Saudi Arabia and in Ethiopia, where our working environments have improved enormously over the past 18 months.”

Background

Since the commencement of major exploration works at Al Godeyer in early 2022, the GMCO exploration team has undertaken mapping, trenching, and a Self-Potential (“SP”) geophysical survey along with diamond and reverse circulation (“RC”) drilling programmes. Completing 3,007m of diamond drilling and 1,169m of RC drilling, for a total of 4,176m of drilling.

The drilling and trenching had three main objectives:

– Testing the volcanogenic massive sulphide (“VMS”) geological model at the surface and depth;

– Understanding the geometry and grade characteristics of the ore body; and

– Increasing geological and grade confidence in the deposit to a level sufficient for resource estimation and reporting.

These objectives have been achieved and with the deposit remaining open along strike to the southeast and at depth, there is considerable opportunity to further expand resources.

Following the completion of the drilling programme GMCO appointed The MSA Group (Pty) Ltd (“MSA”) as the Independent Consultants and Competent Person to prepare a maiden MRE for Al Godeyer in accordance with the Australasian Code for the Reporting of Exploration Results, Mineral Resources and Ore Reserves (“JORC Code 2012”). These estimation works included a site visit by the MSA competent person.

Al Godeyer Work Programme for 2023

Looking forward to 2023, further diamond drilling and additional trenching is being planned to upgrade the ‘unclassified areas’ of the deposit to the Inferred category. In addition to this, further metallurgical test work will be undertaken. If results are in line with expectations, then additional drilling will be planned to upgrade the Resource to the Indicated classification for use in the Hawiah Complex Definitive Feasibility Study (“DFS”) and Reserve calculations.

Maiden Al Godeyer MRE

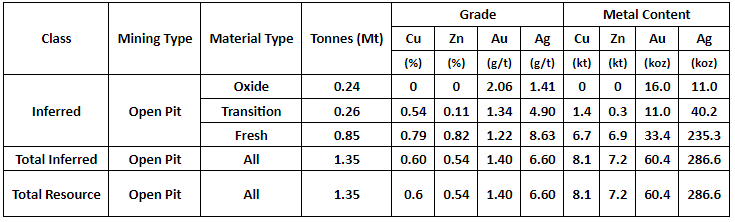

The maiden MRE for the Al Godeyer deposit is detailed in Table 1 below and now totals:

– 1.35 Mt at 0.6% copper, 0.54% zinc, 1.40 g/t gold and 6.6 g/t silver.

Based on this MRE, the Al Godeyer deposit is estimated to contain a total of 8,100 tonnes or 17.9 million lbs of copper, 7,200 tonnes or 15.9 million lbs of zinc, 60,400 gold ounces and 284,600 silver ounces.

Table 1 : MSA Minerals Resource Statement for Al Godeyer,

Effective Date 27 March 2023 (see notes 1 to 7)

Notes on MSA Resource statement:

(1) koz = one thousand ounces, kt = one thousand metric tonnes, Mt = one million metric tonnes.

(2) All tabulated data have been rounded and as a result minor computational errors may occur.

(3) Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability.

(4) The Gross Mineral Resource for the Project is reported.

(5) The Mineral Resource is reported in accordance with the guidelines of the 2012 Edition of The Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (‘the JORC Code’).

(6) A Whittle optimised pit shell was used to report open-pit Mineral Resources. The Whittle optimisation was based on the following assumed technical parameters:

– Pit slope angle: Fresh 56°, Transition 51° and Oxide: 44°.

– Dilution of 10% and mining recovery of 95%.

– Concentrator Recovery via an Albion circuit: Cu 90%, Zn 90%, Au 85%, Ag 60% No recovery of zinc and copper in oxide. Metallurgical factors based on initial metallurgical test-work.

Cost and revenue assumptions:

– Metal Prices: copper 9350 USD/t, zinc 3300 USD/t, gold 1820 USD/oz, silver 26 USD/oz.

– Smelter recovery/payability: copper 96.5%, zinc 83.5%. gold Dore – gold 99.5%, silver 99.6%.

– Mining cost: open pit oxide 2.2 US$/t, open pit transition and fresh 2.4 US$/t. Transport to Hawiah plant 1.125 US$/t and rehandling cost of 0.7 US$/t. Cost adjustment for open-pit depth US$0.004 / vertical m.

– Total Processing cost: oxide 13.9 US$/t, transition and fresh 21.4 US$/t.

– G&A: 5.6 US$/t ore.

(7) The cut-off grade was applied on a net smelter return (NSR) basis: open-pit transition and fresh ore 31.2 US$/t, open-pit oxide ore 23.5 US$/t. NSR was calculated for each block model cell using the following formulae:

Oxide = (copper %*0)+(zinc %*0)+(gold g/t 49.4732 )+(silver g/t*0.4868)

Transition and Fresh = (copper %*76.5870)+(zinc %*20.1118)+(gold g/t *49.4732)+(silver g/t*0.4868)

The MRE is based on 4,176 metres of diamond drilling and RC completed since March 2022 and is reported in accordance with the Australasian Code for the Reporting of Exploration Targets, Mineral Resources and Ore Reserves, The JORC Code (2012).

Trenching, supported by surface diamond and RC drilling has consistently intersected copper-zinc-gold-silver mineralisation contained within gossanous ex-massive and semi-massive sulphides at surface and massive and semi-massive sulphides at depth, over 1.3 kilometres of strike length.

The Al Godeyer deposit has only been drill tested to a vertical depth of 200 metres below the surface and it remains open at depth and along strike to the southeast.