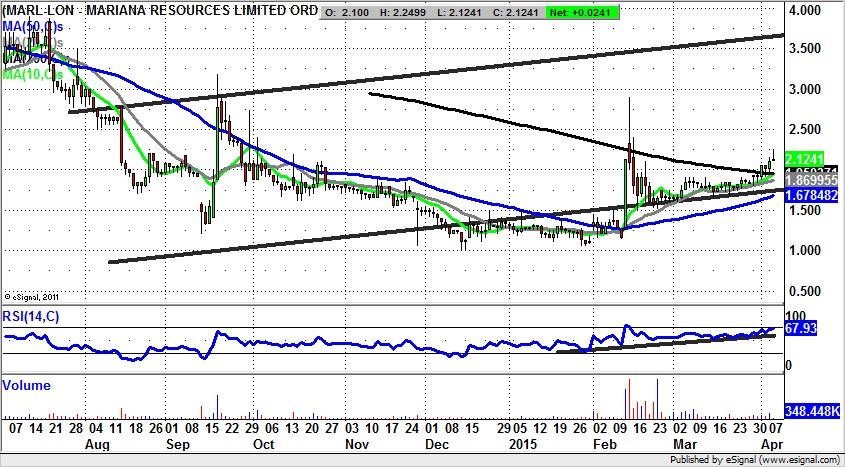

It has certainly been a long road to recovery as far as Mariana Resources ltd LON:MARL shares have been concerned over the past few months, a point which is witnessed by the way that the basing towards the 1p level has taken the best part of 6 months to pan out. This culminated in a brief two day dip to this number in December. Since then it has essentially been recovery all the away apart from arguably the final January floor at 1.05p which at the time would have acted as a bear trap versus the 1.10p low earlier that month. However, this did prove to be a dip to buy into versus the 2014 low of 1p, and this point was underlined by the spike towards 3p in February.

The consolidation since then has been a positive one, testing the initial 1.5p resistance as new support at the end of February. The give-away that this was a new constructive phase came from multiple support tests at RSI 50 along an oscillator up-trend line from the end of January. All of this goes to suggest that the initial for April break above the 200 day moving average at 1.95p is a sustainable trend changing event for Mariana Resources ltd LON:MARL. So much so that we can now pencil in a 3.5p August price channel top target over the next 1-2 months. Only back below the 50 day moving average at 1.67p is currently regarded as outright negative.