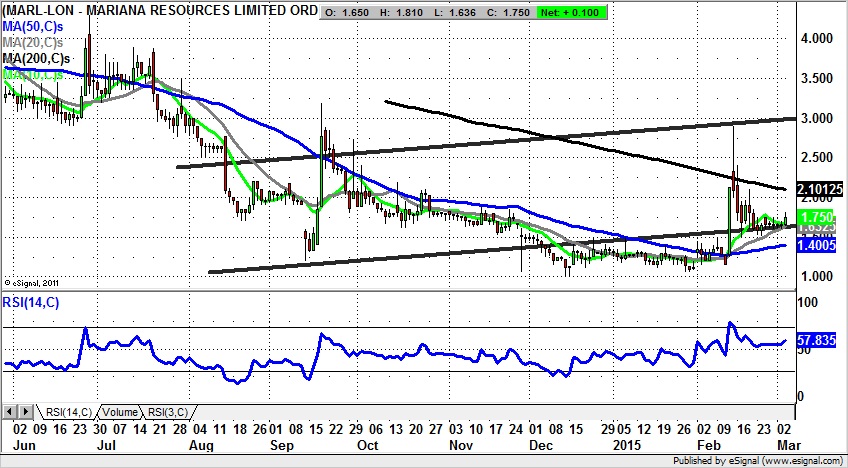

Clearly the big event in the recent past for Mariana Resources shares was the February spike and retreat from just below the 3p zone. Since then the name of the technical analysis game has been to determine when support for the shares might come in on a sustained basis, and the attempt at least intermediate recovery here get underway in earnest? The present charting configuration may provide an answer or two in the sense that we have seen several days of consolidation by the shares at and above the 20 day moving average currently at 1.63p.

The added bonus is that this price action is also well above the former resistance for the stock between December and just before the February spike. During that period resistance was in the 1.5p zone, so we have most likely defined a new support area well above this for the start of March. Indeed, the technical set up now is that while there is no end of day close back below the 20 day line one would expect to see a minimum test of the 200 day moving average at 2.10p. Any prompt recovery of this feature over the next week should lead to a retest of the February spike towards 3p as soon as 2-4 weeks after the 200 day line is conquered. At this stage only a weekly close back below 1.5p is regarded as threatening the recovery argument.