HERENCIA RESOURCES — High-grade Copper Sampling from Pastizal — The AIM-quoted company focused on multi-commodity exploration and development in Chile has announced multiple high-grade XRF sampling results from the Montenegro mine in the southern portion of the tenement. As announced at end-October, Herencia has executed a Binding Term Sheet to acquire 100% of the Pastizal property (which hosts the Montenegro mine) from the consultancy group Consultoria y Servicios Mineros, and expects a formal option agreement to be finalised shortly.

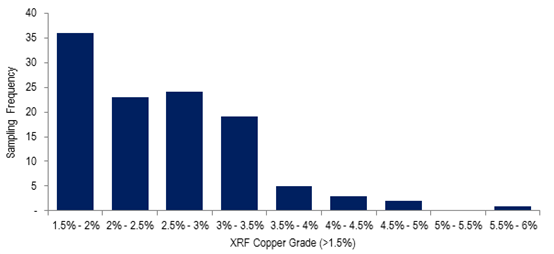

The XRF sampling programme focused primarily on the underground portion of the Montenegro mine, where small-scale mining is currently being undertaken by artisanal miners. Grades of up to 5.9% have been returned from underground sampling, with a broad high-grade manto zone at an average grade of 2.0% Cu. Surface sampling returned grades of up to 2.8%, with multiple values over 2.0%.

Results Profile from XRF Sampling Programme at Pastizal (>1.5% cut off, 113 samples)

Further to the sampling programme, geological mapping work has shown that the mineralisation-hosting limestone units reach up to 50m in thickness, and appear to be structurally controlled by NW-SE and E-W shears.

Location of the Montenegro Mine within the Pastizal Property, and XRF Sampling Pattern

RFC Ambrian Comment: These initial results were promising, particularly given the property’s location adjacent to the company’s flagship Picachos property, although further work programmes will clearly be needed to define the extent and structural controls on mineralisation. As previously noted, the proposed staged-option consideration payable by Herencia for Pastizal comprises:

- On Signing — US$0

- After 6 months — US$50,000

- After 12 months — US$160,000

- After 24 months — US$250,000

- After 36 months — US$400,000

This means only US$210,000 would be payable over the upcoming 12 months, enabling cash conservation in the current market. An additional capped royalty of US$0.05/lb of refined copper on a total of up to 4Mt of ore treated from Pastizal will be payable to the current owner as part of the transaction.

We understand that the company remains in negotiations regarding the Tambillos JV, whereby the Picachos and Pastizal projects would be combined with Errazuriz’s two underground operations and 1Mt nameplate capacity plant. The key benefit to Herencia would be access to the Tambillos plant’s spare capacity, while the company thinks Picachos has the potential to provide a source of lower-cost ore feedstock than Errazuriz’s current underground operations. We await visibility on the terms on the agreement to define the value proposition presented by the JV more accurately.

As at June 2015, the company had £141,000 in cash and a short-term loan of £150,000. The company had net operating cash outflows of £732,000 during 1H15 and expended £325,000 on exploration. Since the end of the period the company has completed two equity financings, one raising US$0.67m and the other £0.5m.