TEAM Asset Management is a Jersey-based independent asset management company of AIM-listed parent, TEAM plc (LON:TEAM).

In this global market commentary, TEAM investment managers reflect on 2022.

The late Queen Elizabeth II infamously described 1992 as an ‘annus horribilis’ during an end of year speech at London’s Guildhall and most investors will look back at 2022 with similar regard. There were very few places to hide as fears over the medicine, namely higher interest rates, needed to tame runaway cast a shadow over markets throughout the year.

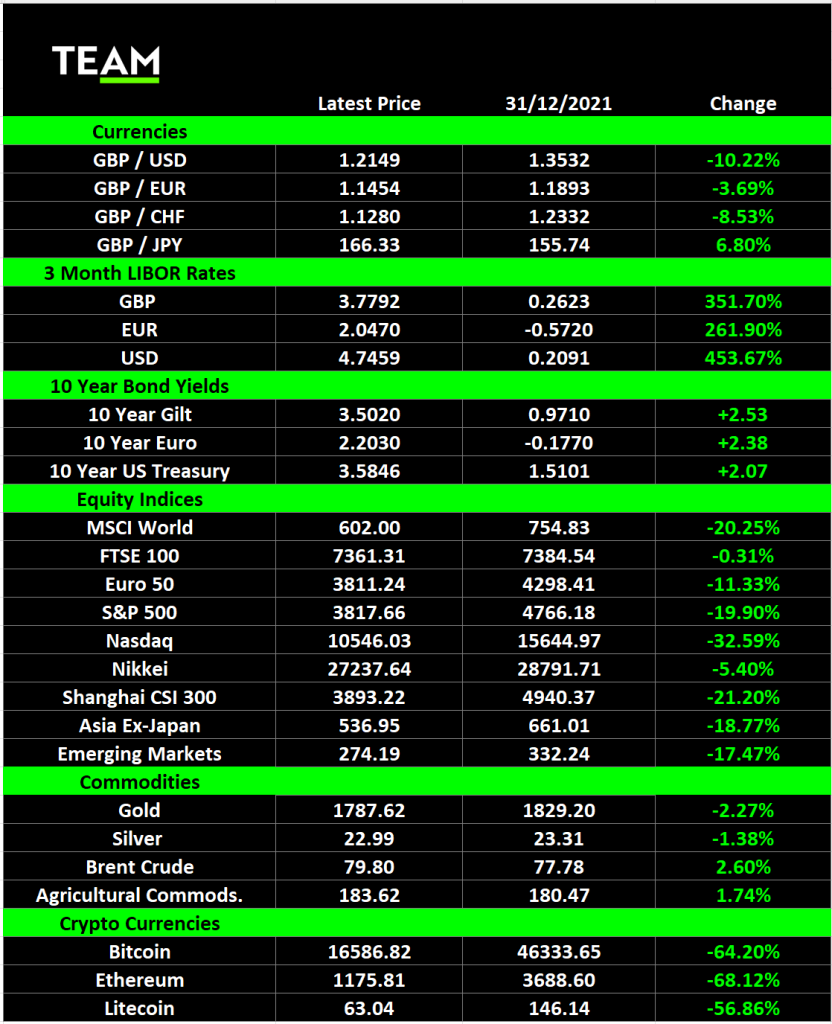

Conventional investment portfolios constructed using a mix of equities and bonds, which have served investors well for decades, were hit hard and offered little protection as both asset classes fell in tandem. The blue-chip S&P 500 index has fallen 20% year-to-date while ‘safe-haven’ UK Government bonds have declined 24%.

Accelerating inflation and higher interest rates are typically associated with booming economies but this time it was different. The first culprit was the global pandemic which disrupted supply chains and sent prices soaring. Then came the Russian invasion of Ukraine in February which amplified prices further as Western governments responded by imposing a raft of sanctions. At the time, Russia’s $1.5 trillion economy represented just 3% of global GDP but it is a major geopolitical power and a leading supplier of energy and commodities. The impact was felt far and wide.

Central banks were caught between a rock and a hard place, aware that the measures needed to curb inflation would slow fragile economies and inevitably push them into recession. They decided that multi-decade inflation was a bigger danger to the long-term health of economies and raised interest rates at an unprecedented pace.

The upper bound of the US Federal Reserve’s target interest rate was still at 0.25% in mid-March but ended the year at 4.5%. The Bank of England increased its benchmark interest rate from 0.25% to 3.50% and the European Central Bank ended an 8-year era of negative interest rates.

Few will forget the drama around the government’s mini-budget in September which triggered historic, and chaotic, moves in UK government bonds and the pound and ultimately led to Liz Truss’ downfall. At one point the pound fell to an all time low of 1.0350 versus the US Dollar in trading conditions reminiscent of 1992’s Black Wednesday. The pound has since recovered to 1.2150 as the return to fiscal orthodoxy under the new prime minister and chancellor has restored some investor confidence.

Whilst most stock returns in the red this year, the returns have been uneven. Energy stocks have returned more than 40%, boosted by bumper earnings as oil and gas prices surged amidst the conflict in Ukraine and deep production cuts from OPEC to offset a weaker demand outlook. China, the world’s largest importer of oil, has shut large parts of its economy down throughout the year to prevent outbreaks of Covid. In contrast, technology (-30%) and consumer discretionary (-33%) stocks have suffered the most from higher interest rates and a deteriorating growth outlook for the global economy.

(Note: Price change is from close of business 31/12/21 to COB 19/12/22)

TEAM plc (LON: TEAM) is building a new wealth, asset management and complementary financial services group. With a focus on the UK, Crown Dependencies and International Finance Centres, the strategy is to build local businesses of scale around TEAM’s core skill of providing investment management services. Growth will be achieved via targeted and opportunistic acquisitions, through team and individual hires, through collaboration with suitable partners, and organic growth and expansion. TEAM Asset Management is a Jersey-based independent asset management company of AIM-listed parent, TEAM plc.