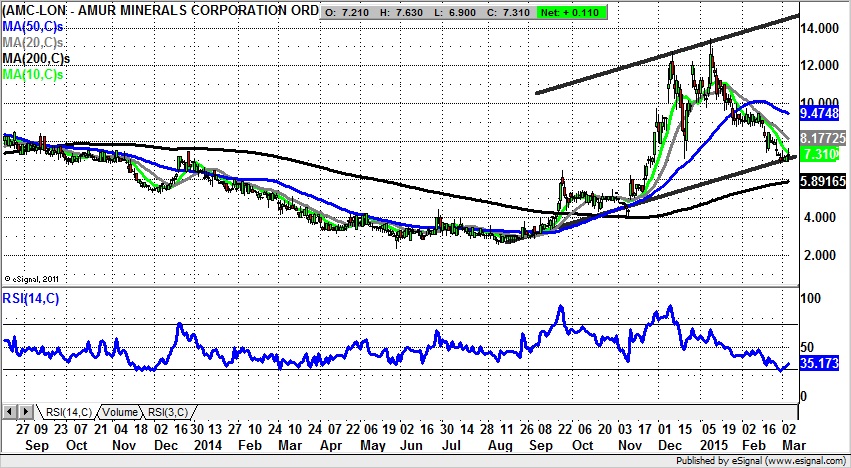

Patience is a virtue amongst the minnows of the stock market, perhaps as much or even more than in terms of timing blue chips. Amur Minerals (LON:AMC) is a good case in point in the sense that even though the overall charting structure here over much of the past year has been and remains positive, the consolidation of the August to January rally did last nearly two months during which time it paid for the bulls to stand aside. However, this week has witnessed the recovery of the former December 7.05p support, as well as the floor of a rising August price channel with its support line running level with the 3 months old support. This provides aggressive traders an opportunity to go long with an end of day close stop loss back below 7.05p. The alternative would be to wait on a momentum buy trigger such as a break back above the 20 day moving average at 8.17p. The view currently is that a clearance of this feature could be as significant as the clearance seen in November when the stock jumped to 12p plus after breaking above the 20 day line. The timeframe on the move higher then was 4-6 weeks, with the same expectation valid currently.