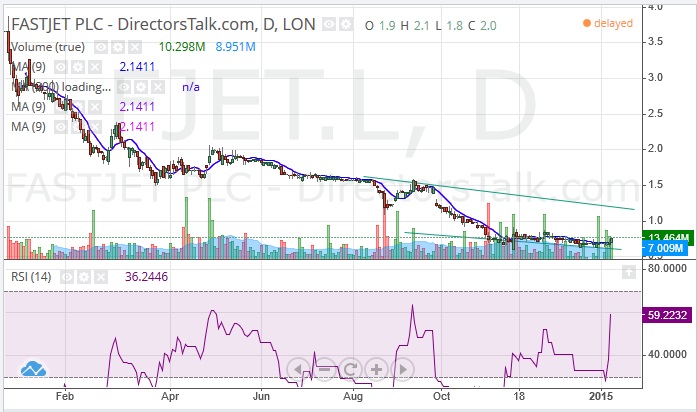

The flight path of FastJet PLC (LSE:FJET) has clearly been to the downside over much of the recent past, with only brief credible attempts at recovery, such as August / September and another flurry in November. But it would appear that now to start 2015 we do have a bona fide bull set up in terms of the aforementioned November price action, with a couple of other positive technical factors also in the mix. The way to approach this situation currently is to use the former 2014 support made two months ago at 0.619p as a major swing low, as well as taking note of the higher low made for January at 0.65p. Indeed, the assumption to make now is that there will be no sustained break of the initial 2015 support ahead of at least an intermediate rally.

This is idea is backed up by the way shares of FastJet have bounced off the floor of a falling trend channel which can be drawn on the daily chart from August. There are also other plus points. They include the way that the price action is now breaking above the 50 day moving average at 0.75p, a feature which has capped the stock since as long ago as August. If you add in the RSI break of the initial 50 plus resistance of early January to leave it in the upper 50’s, we have a leading indicator buy signal for what could possibly be a significant move. The favoured destination at this point is the 2014 price channel top at 1.2p, with the timeframe on such a move seen as being over the next 4-6 weeks at best. Only cautious traders would wait on a weekly close above the initial December resistance at 0.88p before taking the plunge on the upside.