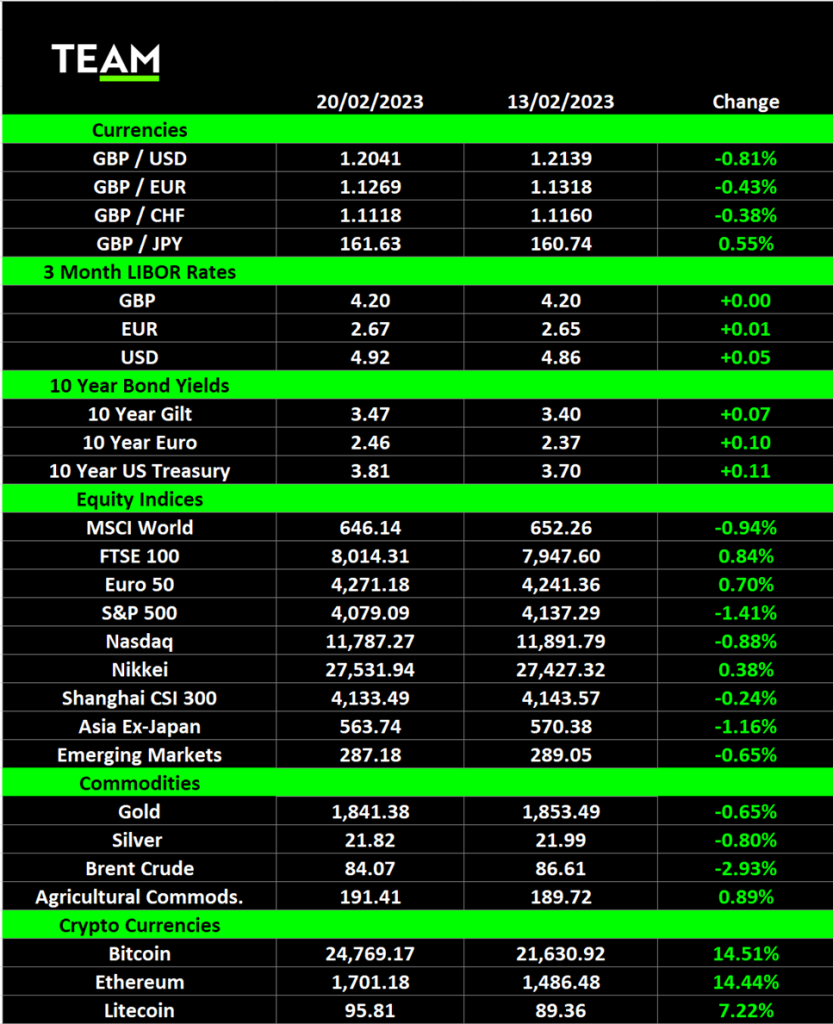

TEAM Asset Management’s global weekly market review for week commencing 13 February 2023. TEAM Asset Management is a Jersey-based independent asset management company of AIM-listed parent, TEAM plc (LON:TEAM).

The prospect of more interest rate hikes put most markets on the backfoot last weeks but the FTSE 100 was a notable exception as it pushed through the 8,000 level for the first time.

The UK’s benchmark stock index has extended its year-to-date gain to 7.5%, reflecting its exposure to the international economy. Companies in the FTSE 100 generate more than three-quarters of their revenues overseas, which has insulated it from the pessimistic outlook for the domestic UK economy.

Company specific news was also a driver for last week’s outperformance. Vodafone gained more than 9% after US telecommunications group Liberty Global revealed that it bought a 4.9% stake in the company worth £1.2 billion.

Liberty Global’s move follows stake-building by other overseas entities last year, including UAE’s state-backed Etisalat (13%) and French billionaire Xavier Niel’s Atlas Investissement (2.5%). The investors are understood to be pushing for a restructuring of the business to spark a revival. Former CEO Nick Read stepped down at the end of last year after the company lost more than 40% of its market value during his 4-year tenure.

Standard Chartered gained a further 5% after it increased its share buyback and dividend in an effort to fend off a rumoured takeover approach by First Abu Dhabi Bank. Although the Abu Dhabi bank announced it is not pursuing a deal last month, it hasn’t ended speculation that it will revive its interest once the six-month period in which it is restricted from making a bid expires in July. A deal would transform stake-backed FAB into a global player.

Manchester United was back in the headlines last week as the deadline to formally declare an interest in bidding for the football club passed. Jim Ratcliffe, the billionaire founder of chemicals group Ineos made his interest known early on and on Friday evening, Sheikh Jasim Bin Hamad Al Thani submitted a bid.

Sheikh Jasim, the son of Qatar’s former prime minister, insists the bid via his Nine Two Foundation will be free of debt and substantial investment will be made to upgrade the football teams, training facilities at Carrington and Old Trafford stadium.

Manchester United’s New York-listed shares have doubled since the Glazer family announced their intention to explore the sale of the club in November. It is expected that the winning bidder will need to go above the world record $4.6 billion paid for a sports team by Denver Broncos owner Rob Walton.

Records were also being broken in the skies. Last week, Air India signed letters of intent to buy 250 planes from Airbus and another 220 from Boeing. The national carrier, bought by the Tata Group from the government last year, is seeking to modernise its fleet to enable it to compete with Gulf airlines, such are Emirates and Qatar Airlines, on international routes and fast growing domestic rivals, including IndiGo and SpiceJet.

The news is a welcome, but challenging, development for the aircraft manufacturers. Airbus has fallen behind delivery targets due to supply chain bottlenecks and has reduced its monthly production goal for its single-aisle A320 from 75 to 65 until the end of 2024. Production of its widebody A350, more suitable for long haul international travel, however, will be increased from 6 to 9 per month.

Elsewhere, better than expected economic data put stocks under some pressure on concerns it will embolden central banks to continue hiking interest rates. The value of retail sales in January in both the UK and US surprised to the upside, suggesting multi-decade low unemployment has helped consumers to be more resilient to the higher cost of living.

Annual CPI inflation in the US also slowed less than expected to 6.4% in January and although UK inflation fell to a 5-month low, it remains in double digits at 10.1%, far above the Bank of England’s 2% target rate. Futures markets are now pricing in two more quarter point interest rate hikes from the BoE by the summer, taking its base rate to 4.5%.

Oil gave up recent gains and Brent crude slid $3 to $84 a barrel as the impact of Russia’s announced production cuts faded. Russia will reduce production by 500,00 barrels a day from March in retaliation to the $60 price cap imposed on its oil by the EU, G7 and Australia. European natural gas prices also fell to an 18-month low of €50 per megawatt hour as the mild winter has enabled storage facilities to stay above normal levels for this time of year.

Author: Andrew Gillham, Senior Investment Manager, TEAM Asset Management (andrewgillham@team.je)