TEAM Asset Management global weekly market review for week commencing 20 February 2023. TEAM Asset Management is a Jersey-based independent asset management company of AIM-listed parent, TEAM plc (LON:TEAM).

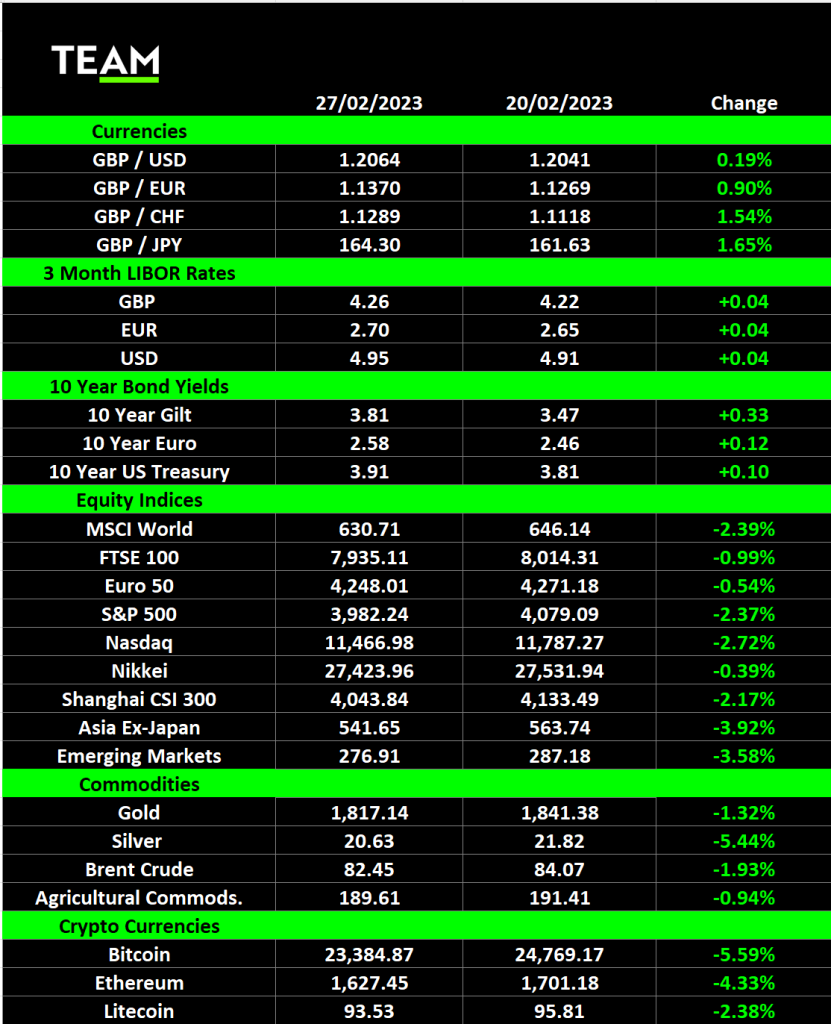

Global stocks endured their worst week of 2023 so far as economic reports revealed that central banks still have more to do to tame inflation. The blue-chip S&P 500 and technology focussed Nasdaq indices fell 2.4% and 2.7% respectively.

Markets had got off to a fast start this year but the rally has lost momentum as better than expected economic data, and disappointing inflation reports, have led investors to reprice the risk that interest rates will go much higher.

On Friday it was revealed that the US personal consumption expenditures (PCE) price index, the Federal Reserve’s favoured measure of inflation, increased by 5.4% from a year earlier in January. Analysts had expected it to slow further from the revised 5.3% level in December.

The index is important as consumer spending accounts for more than two-thirds of the US economy. Multi-decade low unemployment has underpinned higher wages, enabling consumers to spend more on goods and services despite the price increases.

Futures markets now expect the Federal Reserve to respond to the data with three more quarter point interest rate hikes by the summer. At the start of February, just one more rate hike was priced in.

Earnings reports from mining giants BHP Billiton and Rio Tinto also weighed on sentiment last week. BHP reported pre-tax profit fell 30% to $10.2 billion in the second half of 2022 and cut its dividend from a record $1.50 to 90 cents a share. The Australian group blamed a combination of lower commodity prices and around $1 billion of cost inflation, mainly from higher diesel costs. However, it is hopeful recovery in demand from China, particularly for iron ore used to make steel, will improve performance this year. Iron ore accounts for more than half of BHP’s earnings.

Rio announced it will cut its dividend by more than half after full-year pre-tax profit fell 40% to $18.6 billion. The world’s second-largest miner cited similar reasons for the drop and is also pinning its hopes on the re-opening of China’s economy to offset slowdowns in the US and Europe.

Chief executive Jakob Stausholm also asserted that the company will benefit from the global transition to clean energy. Rio is actively seeking to expand its lithium business and it paid $3.3 billion in December to buy out Turquoise Hill to give it greater control of Oyu Tolgoi in Mongolia, one the largest copper mines in the world.

There was, however, some positive news for companies to report. British Airways’ parent International Airline Group reported its first annual profit, €1.3 billion, since the start of the pandemic. Eurpoe’s third largest airline expects to operate 98% of its pre-pandemic schedules this year to take advantage of “robust” forward-bookings and announced it will pay €400 million for the 80% of Spain’s Air Europa that it doesn’t already own.

Rolls-Royce is another beneficiary of the strong rebound in the demand for travel and its shares jumped more than 23% on Thursday after it reported a 57% increase in operating profit to £652 million. It gets paid through long-term contracts based on hours many hours its Trent jet engines are in the air. New CEO, Turan Erginbilgic, also pledged to tackle years of underperformance at the British engineering group by reducing working capital, improving efficiency and implementing a change in culture.

HSBC shareholders had a good week too. The UK and Hong Kong-listed bank raised its dividend to the highest level in 4 years after reporting its fourth-quarter pre-tax profit almost doubled to $5.2 billion. In a bid to appease China’s Ping An insurance group, who is pressuring the bank to split its Asian and Western operations, HSBC also revealed it is planning to distribute a special dividend once the sale of its Canadian business goes through.

The prospect of more interest rate hikes continued to weigh on energy markets and Brent Crude slid another $2 to $82 a barrel. A report from the US Energy Information Administration also revealed crude oil inventories increased to 479 million barrels, around 9% above the five-year average for this time of year.

TEAM plc (LON:TEAM) is building a new wealth, asset management and complementary financial services group. With a focus on the UK, Crown Dependencies and International Finance Centres.

Author: Andrew Gillham, Senior Investment Manager, TEAM Asset Management (andrewgillham@team.je)