Pace of new investment remained subdued in April; as flat oil prices kept enthusiasm for the sector in check; even as the backlog of companies seeking – or likely to seek – funds continues to grow.

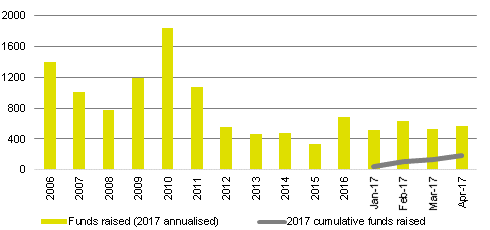

* At least on the face of it, the pace of new investment in AIM-listed oil and gas exploration and production companies picked up slightly in April and now stands at £561 million on an annualised basis versus £523 million a month earlier. The improvement was largely due to the completion of IGas Energy’s rescue fund raising of £49 million. However, with some £31 million of this going to a specialist oil and gas investor, Kerogen Capital, it may not be indicative of a resurgence of enthusiasm for the sector in the broader market.

* After the excitement of the first half of 2016, when the price of Brent crude rallied from a January low of less than US$29 to a June high of more than US$52, oil prices have been relatively flat. As the chart shows, as of the close of business on 16th May 2017, Brent was just 6% higher than it was a year ago in US dollar terms. No doubt, this largely explains why the AIM Oil & Gas index has run out of steam since February. Furthermore, with oil inventories at high levels and the pace of drilling onshore the USA increasing, it could act as a drag on the sector’s stock market performance for some time to come.

* Despite the headwinds, the number of companies lining up to raise funds over the next few months appears to be increasing. Since the beginning of May, i3 Energy, which is pursuing a 16 mmboe development in the UK North Sea, has announced its intention to float on AIM and raise up to US$50 million in the process. In addition, Diversified Gas & Oil, the US onshore producer that listed on AIM as recently as February, said that it plans to raise a minimum of US$20 million to help fund a US$84 million acquisition. Over on the main market, the much larger Kuwait Energy said it plans to raise approximately US$150 million and obtain a premium listing.