TEAM Asset Management is a Jersey-based independent asset management company of AIM-listed parent, TEAM plc (LON:TEAM).

In TEAM’s global weekly market commentary, TEAM’s investment managers provide a stock market review for week commencing 9 January 2023.

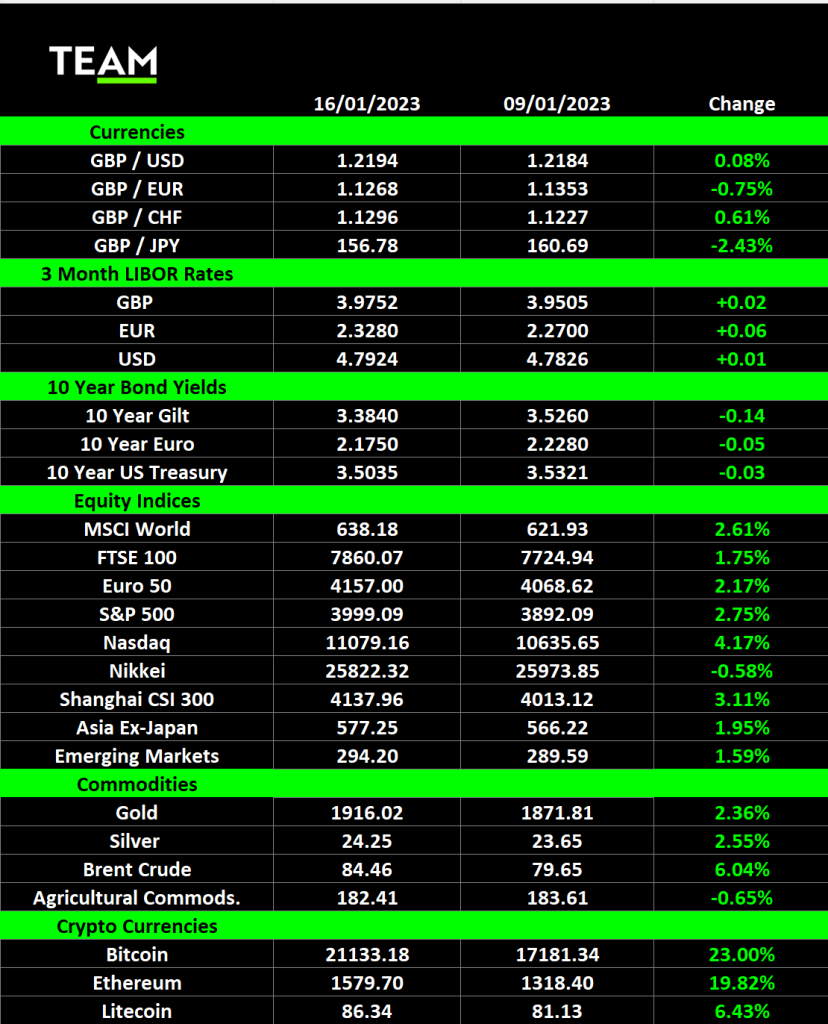

Stock markets around the world extended their early year gains after it was revealed that annual US inflation fell for a sixth straight month. The blue-chip S&P 500 and technology focussed Nasdaq indices gained 2.8% and 4.2% respectively.

Annual US consumer price inflation slowed to 6.5% in December, the lowest level since October 2021, but still far above the Federal Reserve’s 2% target rate. However, it offered more hope that central bank officials will be persuaded to slow the pace of any future interest rate hikes this year. The softer inflation in December was driven by a sharp fall in petrol (-9.4%) and energy (-4.5%) during the month.

It was also reported that the UK economy surprisingly grew by 0.1% in November. Most analysts had forecast the economy would shrink but much stronger activity in the services sector, in part due to football fans watching World Cup games in pubs and bars, offset weaker consumer spending elsewhere.

Economic data aside, there was also plenty of corporate news putting the wind in the sails of individual stocks.

Walt Disney’s shares climbed more than 5% last week on the news that Nelson Peltz, the billionaire activist investor, had built a 0.5% stake via Trian Fund Management, worth around $900 million. Trian’s proposal for Peltz to join the board was rejected, prompting it to go public with a list of “largely self-inflicted” reasons why Disney is “in crisis”. The entertainment giant’s shares hit an 8-year low last month, despite the return of veteran chief executive Bob Iger in November, and a real-life drama is set to play out in the months ahead.

LVMH Moët Hennessy Louis Vuitton has no such problems and its shares have risen more than 16% this year, making new record highs along the way. The gains, along with the fallout at Tesla, have enabled its co-founder, CEO and chairman Bernard Arnault to overtake Elon Musk as the world’s richest man with a net worth of more than $200 billion.

Last week Arnault announced that he had promoted his daughter Delphine to take charge of the group’s Dior division. The eldest of his five children has been number two at flagship brand Louis Vuitton since 2013 and the move has increased speculation that she will eventually succeed her father at the top of the world’s largest luxury group. Three of her brothers also hold executive roles. Whilst Louis Vuitton accounts for around half of the company’s profits, Dior is symbolically important as it is the first fashion house than Arnault acquired back in 1984.

Fourth-quarter corporate earnings season kicked off in earnest on Friday with several of Wall Street’s largest banks reporting, including JPMorgan Chase, Bank of America and Citigroup.

JPMorgan, the largest US bank by assets, reported that it had generated a record of $20.3 billion of net interest income, boosted by the assertive interest rate hikes by the Federal Reserve last year. Total revenue of $35.6 billion also beat consensus forecasts. Although JPMorgan cautioned that net interest income in the year ahead may come under some pressure from it paying higher rates on deposits, its shares overcame an initial sell-off to end the day 2.5% higher.

Bank of America and Citigroup also reported better than expected earnings as higher net interest income offset declines in investment banking revenues and their shares gained more than 2% on the day.

Energy has been one of the few sectors to start off 2023 on the back foot but oil recovered most of the losses as Brent Crude rose 6% to $84 a barrel. The abrupt end of China’s zero-Covid policy has fuelled hopes that demand from the world’s largest importer of oil will normalise this year. Natural gas prices in Europe, however, remained under pressure and the Dutch TTF benchmark has fallen 25% so far this year to €55 per kilowatt hour. The mild winter in Europe has enabled natural gas storage levels to remain above 80% across most of the continent.