TEAM Asset Management provides a global weekly market commentary for week commencing 23 January 2023. TEAM Asset Management is a Jersey-based independent asset management company of AIM-listed parent, TEAM plc (LON:TEAM).

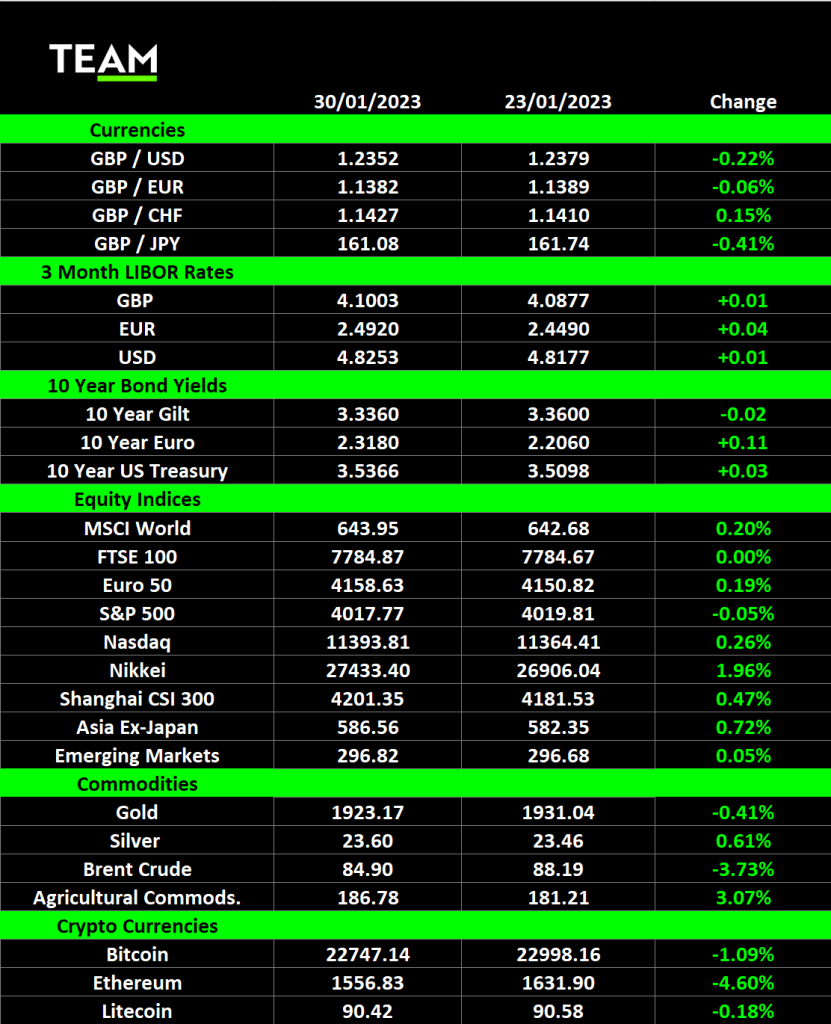

Corporate earnings and economic data reports provided a platform for most markets around the world edge higher. The blue-chip S&P 500 was flat and technology focussed Nasdaq indices returned 0.3%.

However, India was a notable outlier and its benchmark Sensex index fell 2.8% in the wake of a report from activist short seller Hindenburg Research accusing Adani Group of accounting fraud and stock price manipulation. The ports-to-energy conglomerate, controlled by Asia’s richest person Gautam Adani, has been a stellar success story and shares in its flagship company, Adani Enterprises, had risen more than 3,300% over the past five years.

Hindenburg’s allegations wiped off a combined $65 billion from the market value of the seven listed Adani Group companies and came just ahead of the group launching a $2.4 billion share sale to raise funds for new fossil fuel and green energy projects. Adani responded with a 413-page rebuttal over the weekend, and Abu Dhabi’s International Holding Company re-iterated its commitment to invest $400 million into the share sale, but Hindenburg remains steadfast in its claims. It has taken short position in US traded Adani bonds and overseas traded derivatives.

Tesla, another heavily shorted stock, netted short sellers a profit of around $12 billion last year as its share price plunged 65%. However, shares in the electric vehicle maker surged nearly 30% last week, its best weekly performance since May 2013, after it reported better than expected earnings and revenue for the fourth quarter. Chief executive Elon Musk also provided some upbeat guidance, suggesting that the recent price cuts could enable the company to deliver 2 million cars this year. He added “thus far in January, we’ve seen the strongest orders year-to-date than ever in our history”.

Diageo’s earnings also beat most forecasts but its more cautious outlook for the year ahead sent its shares down more than 5% on Thursday. The world’s largest spirits maker, and brewer of Guinness, warned that sales growth is slowing more rapidly than expected in its key North American market as consumers trade down from more expensive drinks.

It was a similar story for Microsoft which reported better than expected earnings for the fourth quarter but its shares sold off after chief executive Satya Nadella gave some more tepid guidance. He noted that some business customers were pushing back spending on their next cloud projects which would impact its main engine of growth. Revenue from its Azure cloud services business increased 38% in the fourth quarter, down from 42% in the previous quarter.

Microsoft also confirmed that it has extended its partnership with OpenAI, the creator of ChatGPT, with a multi-year, multibillion dollar investment. The commitment reflects the company’s view that AI will have an impact similar to the magnitude of the personal computer, the internet, mobile devices and the cloud.

Some companies have been more resilient to the slowing global economy, including LVMH Moët Hennessy which reported its second straight year of record sales and profits last week. The world’s largest luxury goods maker generated profits of €14 billion and will increase its dividend by 20%. Guidance was also positive and it is optimistic that the relaxation of Covid restrictions in China, its second largest market, will offset slowdowns elsewhere this year.

There is a near consensus that Western economies will fall into a recession this year but it was revealed last week that the US economy grew at an annualised rate of 2.9% in the fourth quarter. Although it is a slowdown from the 3.2% growth rate in the third quarter, thus far multi-decade low unemployment has enabled consumer spending to hold up better than expected in the face of higher borrowing costs and inflation. Markets have fully priced in another quarter point interest rate hike from the Federal Reserve on Wednesday.

Energy markets slipped back and Brent Crude fell to $85 a barrel amidst concerns that higher interest rates will dampen demand. An advisory committee of the OPEC cartel will review production policy later this week and no change to output is expected. BP’s annual energy outlook report also cast a cloud over the longer-term prospects for oil and gas demand, predicting that the upheaval triggered by Russia’s invasion of Ukraine will accelerate investment into renewables as countries prioritise energy security.