It is a little over a year since the Fed (rather belatedly) introduced its first interest rate hike of this cycle.

At the time, consensus expectations were for the Fed Funds rate today to be under 2%. We are sitting at a

target range of 4.50%-4.75%.

The 450 basis points of cumulative rate hikes so far eclipses the speed and magnitude of any cycle since

1980, and, prior to that, 1973.

Relative to all prior hiking cycles of the previous 70 years, this cycle has delivered:

• The weakest US growth

• One of the largest declines in US housing and manufacturing activity

• The worst S&P performance, and

• One of the most inverted yield curves

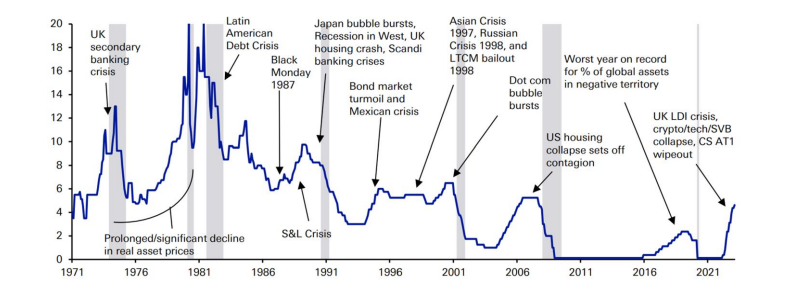

The chart below courtesy of Jim Reid and the Deutsche Bank team illustrates how effective Fed hiking

cycles are in breaking things:

To quote: ‘we’re now increasingly annotating for this cycle. If the US economy moves into recession in H2

2023 as we expect there will likely be more annotations ahead’.

Prior episodes have traditionally been accompanied by soothing market rhetoric early in their development. ‘X is contained’, ‘Y is an isolated event’, ‘Z represents idiosyncratic risk’ are typical phrases

ascribed to a mini crisis that ultimately manifests into something systemic.

This cycle feels eerily similar.

Whilst we do not dismiss the possibility of a muddle-through scenario out of hand, history suggests we

may be in for a (continued) turbulent ride this year.

We side with the view that more annotations are likely forthcoming. Our modus operandi remains the

pursuit of robust portfolio defence across our range of strategies.

TEAM plc (LON:TEAM) is building a new wealth, asset management and complementary financial services group. With a focus on the UK, Crown Dependencies and International Finance Centres, the strategy is to build local businesses of scale around TEAM’s core skill of providing investment management services.