In the wake of recent events, sell side forecasters have been scrambling to (re)adjust their view on the US

Federal Reserve’s likely course of policy action.

From a state of almost universal agreement a week ago, the potential range of outcomes now incorporates pushes, pauses, and even pivots, from Powell & Co. maintaining course with a 50-bps raise, to a cut of 25 bps, a scenario unthinkable this time last week.

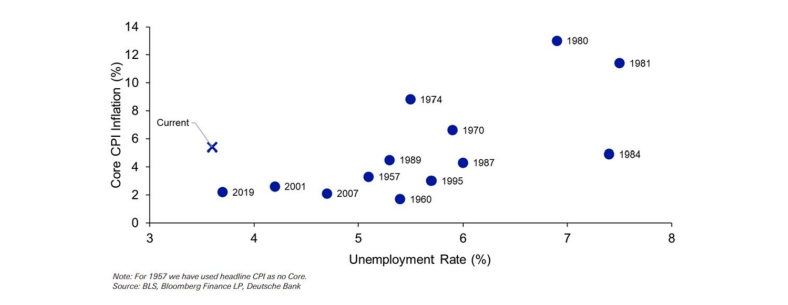

Regarding the latter, an excellent graphic below from Jim Reid and the team at Deutsche Bank observing

where both core US inflation and unemployment readings stood at the time of the first Fed cut during

previous cycles. The study incorporates the prior 70 years:

In sum, a cut against the current backdrop would set a historical precedent; core inflation has only been

higher in the early 1970’s/early 80’s, and rates have never been cut with employment this low.

Their conclusion is that on balance, firmer evidence of unemployment pressures and/or that inflation is

closer to target is likely required before cuts can begin. Caveat: further market turmoil in the coming days

may convince policymakers that both outcomes will materialise quickly.

Whichever way you cut it, Chairman Powell and colleagues face quite the predicament.

Visit us at www.team.je