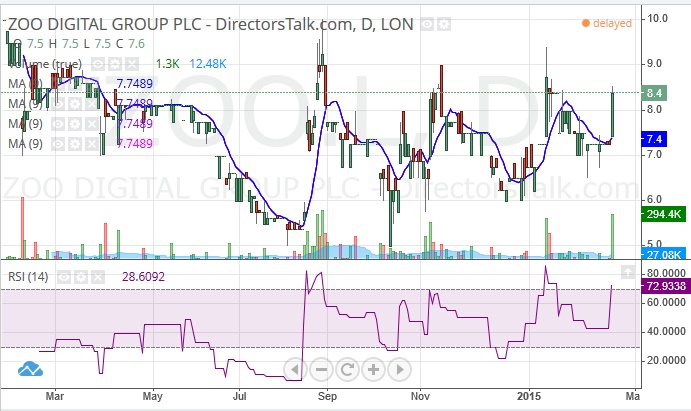

It is clear from the recent history of Zoo Digital that the shares have been attempting to regroup following the autumn 2013 spike which took the stock through 14p. Since then the pattern has been one of consolidation in the wake of last summer’s dip towards the 5p level.

The consolidation for the price action between 5p and 10p since the middle of 2014 does however look to be complete, something which is said on the basis of last month’s break back above the 200 day moving average at 7p for the 50 day moving average. The suggestion now is that at least while there is no break back below the 50 day and 200 day lines one would expect the shares to build progressively over the next 4 to 6 weeks with an initial target back of August resistance at 10p.

Overall though, it would appear that in the wake of last year’s consolidation enough work has been done here to deliver a retest of 2013 resistance over the next 3 to 4 months, even though cautious traders would still be wishing to see sustained price action through 10p before giving the benefit of the doubt to the situation once again.