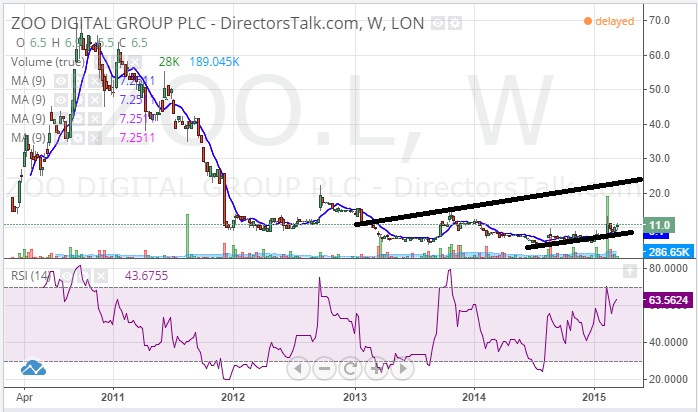

For Zoo Digital we have seen the present recovery in the wake of a February gap to the upside come after the extended base for the shares made since the summer between 5p and 6p. The main point of interest so far this year other than the February gap has been the recovery of the 200 day moving average now at 7.3p. But what can be said now is that the key feature on the daily chart in terms of the price action going forward is the floor of the February gap at 8.54p. While shares of Zoo Digital are above to remain this level we would remain optimistic regarding the prospects for this situation, especially so given the way that the price action since the move to the upside has taken the shape of a V shaped bull flag. Such bull flags normally only accompany the sharpest of bull moves, and this is what we are expecting currently.

Indeed, the technical target at this point is seen as being as great as the top of a rising trend channel from the beginning of 2013 at 25p, a target which could be achieved as soon as the next 2-3 months – taking out the best levels of 2012 above 20p. In the meantime any weakness here towards the 8.54p level can be regarded as a dip to buy into.