Alien Metals Ltd (LON:UFO), a global minerals exploration and development company, has provided an updated on Exploration and Corporate Activities for its Australian Operations. This includes drill results from Elizabeth Hill, Australia’s highest grade silver deposit, as well as a progress update from its wholly owned subsidiary, Iron Ore Company of Australia Pty Ltd 90% owner and operator of the Company’s flagship development, the Hancock Iron Ore Project.

Highlights

· High-grade Elizabeth Hill results received

· Re-interpretation of EH geological model extends area of known mineralisation and demonstrates potential for a high-grade bulk tonne silver rich polymetallic orebody at Elizabeth Hill

· IOCA now in receipt of final fixed price tender responses from all suppliers for the development of the Hancock Project

Analytical results for hole 22AMC001 received. Hole successfully designed and drilled to confirm extensions to the main silver lode. High grade results include:

· 42 metres (“m”) at 12.1 troy ounces (“ozt”) of silver (“Ag”) and 0.52% lead (“Pb”) from a depth of 8m.

o Equivalent to 42m at 1.05% nickel (“Ni”)

o Equivalent to 42m at 4.6 grammes per tonne (“g/t”) gold (“Au”)

· Including 13m at 35.4ozt Ag, 1.11% Pb and 0.48 g/t gold-platinum-palladium (“Au+Pt+Pd”) from 16m

o Equivalent to 13m at 3.04% Ni

o Equivalent to 13m at 13.3g/t Au

Re-examination & reinterpretation of EH data demonstrates a far larger high-grade/high-volume mineralised envelope. Re-analysis of historical drilling located within this newly identified mineralised envelope returned the following results.

· 52m at 22.6ozt Ag and 0.009% Pb from AMEHRC009

o Equivalent to 52m at 1.89% Ni

o Equivalent to 52m at 8.2 g/t Au

• 19.7m at 102.8ozt Ag and 0.27% Pb from 21EHDD003.

o Equivalent to 19.7m at 8.58% Ni

o Equivalent to 19.7m at 37.5g/t Au

Eight holes in total were drilled at EH. Five holes in a single fence several hundred metres to the north failed to identify the felsic / mafic contact suggesting a change in trend of the mineralisation. A detailed review will be undertaken prior to additional drilling being undertaken.

Two holes designed to extend the mineralised envelope down dip and to the south also failed to reach target depth due to excess water inflow, presumably from the flooded mine. It is expected that these two holes will be completed by adding a diamond tail when a suitably purposed rig is in the area to reduce mobilisation costs. Therefore, these extensions of the orebody remain untested.

Of significance, findings from a re-evaluation of EH strongly indicates the original EH high-grade, narrow silver vein is in fact the high-grade core of a much larger mineralised halo. An example of this is the recent drill result of 42 metres at more than 12 troy ounces of silver.

This new geological understanding opens the possibility for a significantly larger mineralised system at surface.

Results to date confirm and enhance the Company’s view EH could be a significant deposit of metal. Drilling reported anomalous Au, Pt and Pd over the same interval, all of which points to a potential poly-metallic occurrence at depth.

Hancock Mine Development Update

IOCA has now received final fixed price tender responses from suppliers for the development of the Hancock Project DSO iron project. Pleasingly, all responses are in line with Scoping Study estimates and continue to demonstrate strong project economics. The Company will now start the selection process for preferred partners and move into detailed contract drafting.

The Company continues to progress Native Title approvals as well as other permitting necessary to start production. Providing guidance as to a timeline for completion is difficult as many aspects are outside the company’s control or involve commercial and legal sensitivities that are subject to negotiation and documentation. The Company appreciates stakeholder patience on these aspects and would like to reassure shareholders the Company is working hard towards its stated goals and will update shareholders once complete. Once Native Title is completed, the Company will immediately submit a Mining Proposal for State Approvals of the Project which is expected to take between 2-3 months for approval from submission. The Company intends to start civil and site works immediately after Native Title is received in parallel to the grant of the mining licence.

Upcoming Work Programmes

• Drill results at Munni Munni for Ni & Cu expected soon.

• Maiden Ore Reserve for the Hancock Project

• Updated Feasibility Study to reflect supply chain engagement and tender responses for the Hancock Project

• Documenting agreements for various services and logistical providers

Rod McIllree, Executive Chairman, commented:

“We continue working through an updated economic study for Hancock and I’m pleased to report that the investment remains an attractive opportunity for the Company and its stakeholders. Its development is our primary objective. In the coming months we expect to deliver an updated resource, an updated feasibility study, conclude contracts associated with mining, transport and material handling as well as finalise financing necessary to facilitate an investment decision.

Furthermore, results from recent drilling as well as a bottom-up re-examination of Elizabeth Hill are highly encouraging. When these drill results are put in terms of nickel and gold equivalents (such as 19.7m at 8.58% nickel or 52m at 8.2 g/t gold) what emerges is an insight into the potential value of this newly recognised broader mineralised system and the economic implications of such. Elizabeth Hill has just evolved into something much more serious certainly for the exploration team who through their hard work this significant discovery has been made.”

Hancock Project Overview

The Hancock Project, 18km north of Newman, Australia hosts a JORC compliant Inferred Mineral Resource of 10.4 million tonnes (“Mt”) at 60.4% iron (“Fe”) (Announcement: 22 September 2021). The independent Scoping Study (Announcement: 19 October 2021), commissioned by the Company demonstrated exceptionally strong returns, with highlights including:

• Optimisations completed using an iron ore price of US$100/t result in the design pits extracting all the initial JORC resources identified to date (10.4Mt at 60.4% Fe)

• Initial Life of Mine studies show the current resource will sustain an eight-year mine life based on the following parameters:

o Mining rate of 1.25Mtpa with a pre-production capital estimate of <US$30 million

o Low waste to ore mining ratios

o Operating costs of <US$60/t FOB

o Potential to identify additional resources on the Hancock licence.

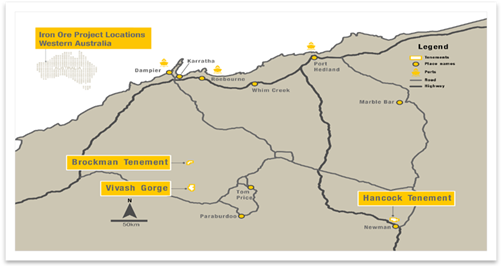

Figure 1: Location of Hancock Iron Ore Project, Western Australia

Overview of E lizabeth Hill Project and Surrounding Munni Munni Area

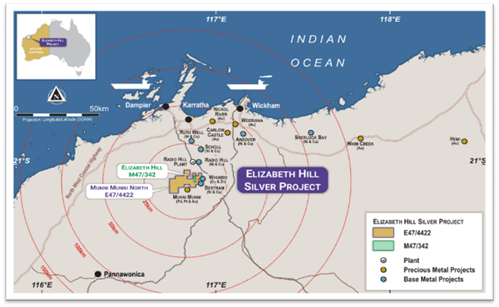

Elizabeth Hill is located 45km southeast of the city of Karratha, Western Australia. The project is situated in the Pilbara Craton, a region well-known for precious metal mineralisation. Elizabeth Hill is recognised as being Australia’s highest-grade silver mine when it was in production between 1999-2000.

Elizabeth Hill had a pre JORC 2012 resource of 4.05Moz of silver prior to start of mining and was renowned for its exceptional native silver nuggets and silver wires . Over 1 million ounces of silver, mainly in the form of nuggets, were produced between 1999-2000 from a single shaft and small processing plant before the mine was closed due to water inflow. Elizabeth Hill is 100% owned by the Company and Alien is undertaking a complete review of all historic data from both surface and underground drilling with a view to reopening the mine.

The Company also owns the nearby Munni Munni Project (4km southwest of Elizabeth Hill) which hosts significant PGE mineralisation. Munni Munni has a historical non JORC compliant resource of 24Mt at 2.9g/t Platinum Group Metals (“PGM”) and gold for 2.2Moz. This includes 1.14Moz of palladium, 0.83Moz of platinum, 152koz gold and 76koz of rhodium. The Munni Munni Project is one of Australia’s largest PGM deposits.

Figure 2: Location of EH Project and Munni Munni PGM Ni Cu Project, Pilbara, Western Australia

Figure 3: Plan view showing historical mine and broader mineralised area at EH, Pilbara, Western Australia

Alien Metals Ltd is a mining exploration and development Company listed on the AIM market of the London Stock Exchange. The Company’s focus is on delivering a profitable, long life direct shipping iron ore operation based out of the Pilbara in Western Australia. In 2019, the Company acquired 51% of the Brockman and Hancock Ranges high-grade (Direct Shipping Ore) iron ore projects and in December 2022 moved to 90% legal and beneficial ownership. The Company also acquired 100% the Vivash Gorge Iron Ore project in the west Pilbara in July 2022.