TEAM Asset Management’s global weekly market review for week commencing 27th March 2023. TEAM Asset Management is a Jersey-based independent asset management company of AIM-listed parent, TEAM plc (LON:TEAM).

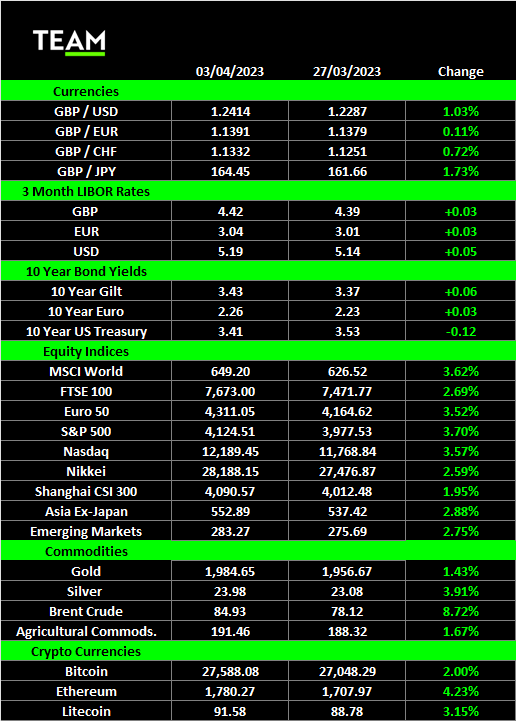

No news is sometimes good news and it felt that way last week as a banks made fewer headlines and investor confidence showed signs of recovery. Some of the recent inflows in to safe-haven assets such as government bonds and precious metals reversed back into equities and the blue-chip S&P 500 and technology focussed Nasdaq returned 3.7% and 3.6% respectively.

The Nasdaq has returned 17.0% in the first three months of 2023, its best quarter since the second quarter of 2020 when policymakers unleashed emergency stimulus measures to protect the economy during the Covid pandemic. Technology stocks have benefited more than most from moderating interest rate expectations.

There were contrasting fortunes for some of the most well-known high street fashion stores. Shares in Stockholm-listed Hennes & Mauritz jumped more than 15% on Thursday to a 12-month high after it announced a surprise profit of SEK 725 million for the three months to the end of February. The world’s second largest fashion retailer booked a SEK 1 billion gain by revaluing its stake in the digital second-hand platform Sellpy and reduced its unsold stock inventory to the lowest level since 2020.

Shares in Next, however, moved in the opposite direction and fell 4.5% on Wednesday after CEO Lord Wolfson warned the company faces a difficult year ahead. The UK fashion and homeware chain, which has 466 stores across the country, generated record annual profits in 2022 but expects profit to dip around 8% to £795 million this year due to higher cost inflation and weaker sales. Next also revealed it expects to raise prices by 7% for the spring-summer season and by 3% for autumn and winter items.

The 39th annual WrestleMania was held over the weekend and more than 80,000 fans attended both nights at a sold out SoFi Stadium. Millions also paid to watch the event on television at home. The blend of sports, entertainment and scripted story lines continues to attract a wide fanbase and on Monday it was announced that Endeavour Group, owner of the martial arts franchise Ultimate Fighting Championship (UFC), had reached a deal to acquire World Wrestling Entertainment for an enterprise value of $9.3 billion. Expectations of a sale had pushed WWE shares up 30% this year.

Tesla revealed it delivered a record 422,875 vehicles in the first quarter of 2023, a 4% increase of the previous quarter, but fell behind on meeting Elon Musk’s target of achieving 2 million deliveries this year.

Tesla cut the prices of its cars by as much as 20% in January in a bid to boost sales and defend market share against established car manufacturers and newer electric vehicle companies. It is also facing fiercer competition in China with BYD Co set to challenge Tesla for the number one position this year. Tesla shares fell 6% in Monday’s trading session, trimming its year-to-date gain to 58%, on concerns it may have to cut prices further to boost sales.

In a busy week for inflation reports, there were some mixed signals. Inflation across the Eurozone is decelerating with energy prices but at very different speeds. Annual consumer price inflation in Germany from 9.3% to 7.8% in March whilst in Spain in almost halved to 3.1%.

German food prices rose 22.3% from a year earlier and the tight labour market in Europe’s largest economy is pushing up wage demands. Last week, public sector workers rejected an offer to increase the wages by almost 6% in 2023 and 2024 and the largest walkout in more than three decades brought railways and airports to a near halt. Unions are seeking a 10.5% pay rise.

Money markets futures are now pricing in another quarter percentage point interest rate hike from the European Central Bank in May.

Weaker energy prices pushed Opec+ into action over the weekend and they announced a cut to production of 1.2 million barrels of oil a day on Sunday. The surprise move made an immediate impact and Brent Crude, the global oil benchmark, jumped $5 to $85 a barrel on Monday. Saudi Arabia will cut production by 500,000 barrels a day and Iraq by 211,000. Other members including the UAE, Kuwait, Algeria and Oman are also making cuts which have been criticised by US officials. Higher oil prices make the task of the Federal Reserve, and other central banks, to bring down inflation more difficult.

Author: Andrew Gillham, TEAM Asset Management, Senior Investment Manager, (andrewgillham@team.je)