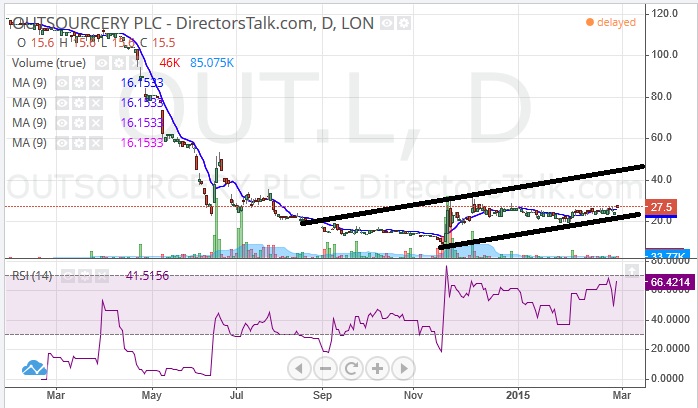

We have been treated quite a journey as far as the price action of Outsourcery (LON:OUT) has been concerned over the past year, with the period divided into two around the November rebound for the shares.

This event cuts the daily chart in two given the way that having traded almost totally below the 50 day moving average since February 2014, since the rebound in the autumn we have seen the 50 day line coming in as support almost continuously.

But the real excitement over the near-term from a technical perspective is the way that we have not only seen the 200 day moving average now at 25p broken over the past couple of sessions, but also this has been delivered via a gap to the upside.

Given the way that a break of the 200 day line is traditionally a key trend changing development, this has to be regarded as significant, especially when added to by the latest bounce off an uptrend line in the RSI window.

The suggestion now is that while there is no end of day close back below 200 day moving average we can expect further progress for Outsourcery shares. The best case scenario target at the moment would be seen as 47p over the next 1 to 2 months, at the top of a rising November price channel.