Paul Griffiths, Chief Executive of Predator, commented: “We are delighted to announce the pricing of Predator’s imminent Admission to the Official List by way of a Standard Listing. This is an important milestone for the Group. Our portfolio of assets has been built to create operational momentum thus ensuring that we are ideally-placed to grow rapidly, as market sentiment in the oil and gas sector improves, and drive returns for all stakeholders.”

Predator Oil & Gas Holdings Plc, the oil and gas company focused on developing Enhanced Oil Recovery onshore Trinidad using carbon dioxide injection and exploration and appraisal offshore Ireland, today announced the successful pricing of its initial public offering by way of a conditional placing of 46,428,600 ordinary shares of nil par value each at 2.8 pence per Ordinary Share by Novum Securities Limited and Optiva Securities Limited. The Placing was significantly over-subscribed.

On Admission the Group will have 100,137,150 Ordinary Shares in issue, all of which will be admitted to trading by way of the Standard Listing. It is expected that Admission will become effective and that dealings will commence in the Ordinary Shares on the Official List at 8.00 a.m. on Thursday 24 May 2018 (“Admission Date”).

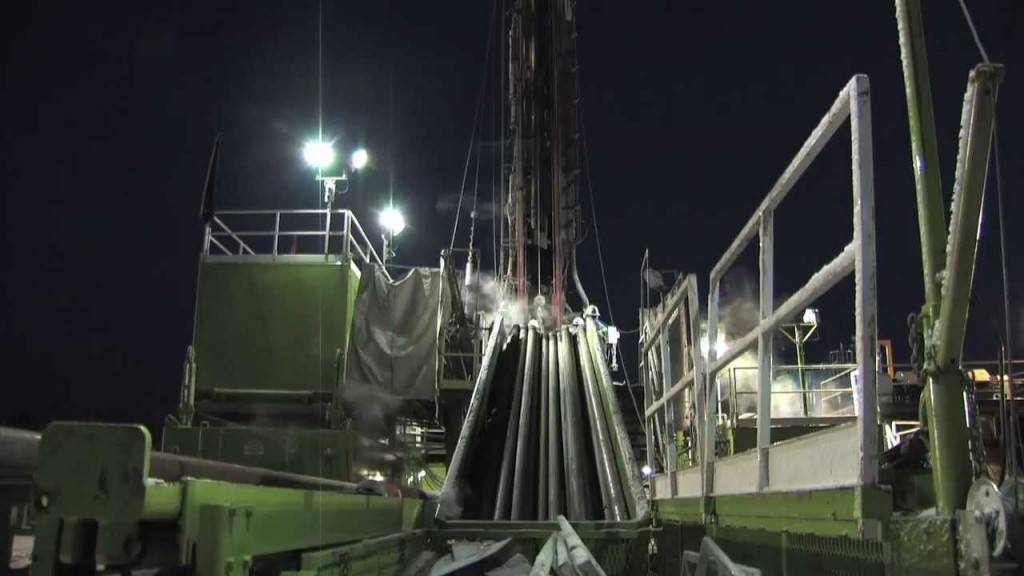

Through a Well Participation Agreement with FRAM Exploration Trinidad Limited (“FRAM”), Predator will be financing near-term drilling in the mature, producing Inniss Trinity oil field in return for 100% recovery of its investment from production from the wells before sharing profits on a 50:50 basis with FRAM. Predator will also assimilate data from the drilling to input into planning and executing a Pilot Enhanced Oil Recovery Project, subject to regulatory consent and approvals.

Offshore Ireland Predator seeks to move forward to further develop its existing licence position subject to regulatory consent and approvals. The Predator near-term focus is on gas exploration immediately adjacent to the Corrib gas field infrastructure, where in 2017 Shell sold its 45% stake in the Corrib gas field, subject to regulatory consent and approvals, for a reported USD 1.23 billion. Successfully exploring for and developing Ireland’s potential indigenous gas resources, in areas where medium-term satellite tie-backs to producing infrastructure are feasible, is seen by Predator as a means of reducing carbon dioxide emissions in the future by providing the opportunity for gas to replace coal and oil as a source of energy.

Key Highlights:

· The Placing Price of 2.8 pence per Ordinary Share will equate to a market capitalisation of the Company of approximately £2.8 million on Admission.

· The Placing will raise gross proceeds of approximately £1.3 million.

· Admission to the Official List and the commencement of dealings is expected to take place at 8.00 a.m. on Thursday 24 May 2018 under the ticker PRD and ISIN number JE00BFZ1D698.

· Novum and Optiva are acting as Joint Brokers and Joint Bookrunners in relation to the placing and Admission to trading on the Official List.

Full details of the Placing and Admission are included in the Admission Document, which will be available on the Company’s website (www.predatoroilandgas.com) on the Admission Date and are currently available in the Novum and Optiva offices and at the Company’s registered office in Jersey. Defined terms used in this announcement shall, unless the context provides otherwise, have the same meaning as set out in the Prospectus.