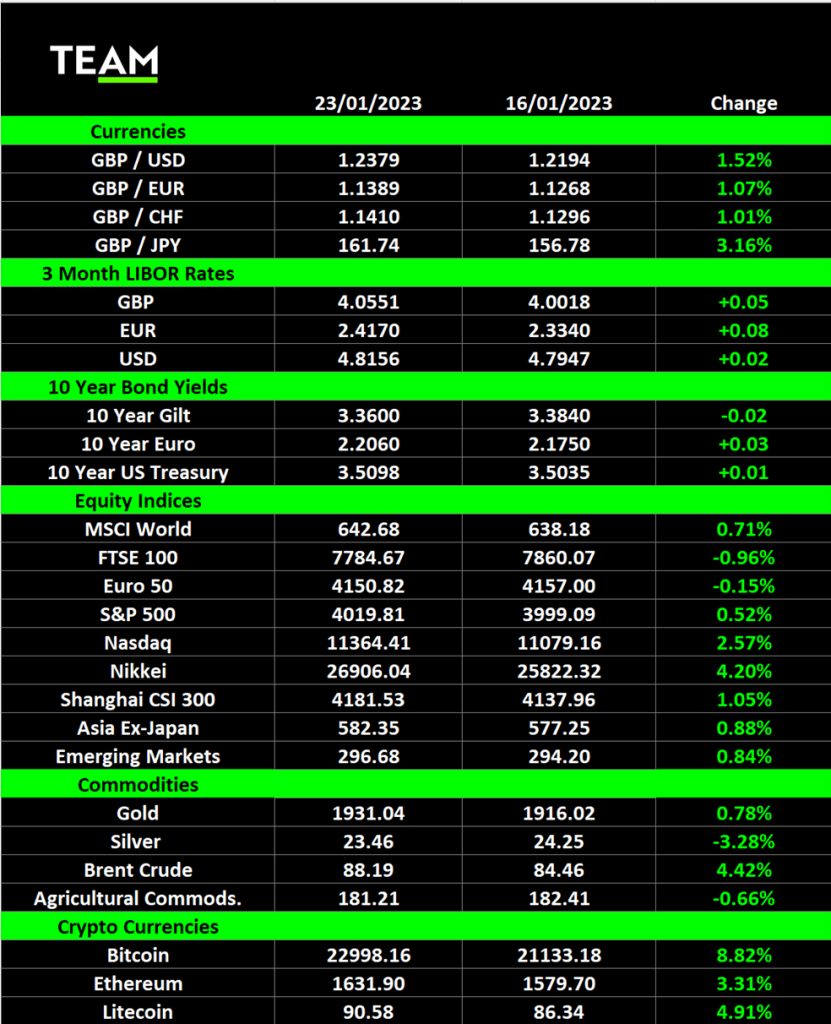

TEAM Asset Management provides a global weekly market commentary for week commencing 16 January 2023. TEAM Asset Management is a Jersey-based independent asset management company of AIM-listed parent, TEAM plc (LON:TEAM).

Global stocks moved higher for a third straight week, albeit with some resistance from mixed corporate earnings reports and more evidence of economies heading toward recession. The blue-chip S&P 500 and technology focussed Nasdaq indices gained 0.5% and 2.6% respectively.

Goldman Sachs shares fell more than 6% last Tuesday after it posted its largest earnings miss in a decade. The Wall street bank’s quarterly profit fell 66% from the same period a year earlier, rounding out a difficult year in which investment banking revenues were hit by the slump in dealmaking activity. It also increased provisions to cover potential losses on loans as the economy slows. Prior to the earnings release, Goldman had already warned it will cut thousands of jobs and slash staff bonuses.

Another member of the Dow Industrial Average, Procter & Gamble, also reported earnings which left investors disappointed. The consumer goods giant’s net income declined to $3.9 billion, from $4.2 in the same period a year earlier, due to weaker sales volumes in all of its division and FX headwinds from the stronger US Dollar. Higher raw materials and freight costs squeezed gross profit margins by 1.6% to 47.5% but P&G raised its sales growth guidance for 2023, pledging to increase prices further.

There was much better news for Netflix whose shares lost more than 50% last year amidst fierce competition from rivals such as Amazon Prime, Disney+ and HBO Max and many households cut back on discretionary spending. The video streaming platform added a much better than expected 7.66 million paid subscribers during the fourth quarter, the first reporting period to include its new lower cost ad-supported membership. The disclosure that Reed Hastings, who co-founded the business in 1997 as a DVD-by-mail service, is stepping down didn’t dampen the mood and Netflix shares jumped 8.5% on Friday, extending their year-to-date gains to 21%.

Ryanair doesn’t report its earnings until later this month but its bullish chief executive Michael O’Leary asserted the airline is holding up extremely well despite the difficult economic climate and demand for air travel across the UK and Europe is strong. The budget carrier reported 4.95 million bookings in the second week of January, the highest ever in its 30-year history, despite average airfares rising to around €53-€55. O’Leary added that is highly unlikely that the airline will need to resort back to selling €9.99 seats, even during low season. Ryanair shares are 23% higher so far this year.You might also enjoy reading Weekly market commentary: Disney, Manchester Utd, China Covid controls and more, TEAM Asset Management

Chemicals billionaire Sir Jim Ratcliffe formally confirmed his interest in buying Manchester United. Born and raised in Manchester, Sir Jim is a lifelong supporter of the football club and with a net worth of $15 billion, according to Forbes, he has the resources to put together a serious bid. The New York listed Manchester United shares have risen almost 80% since the Glazer family revealed their intention to sell, or seek outside investment, in November and other interested parties are said to include the US investment firm Sixth Street and sovereign wealth funds in the Gulf Region. The Glazers are reported to value the club at least £5 billion, despite the substantial investment needed to upgrade its stadium and training facilities.

Another European football giant was in the headlines for very different reasons. Shares in Juventus fell 13% on Monday after the Italian Football Federation hit the club with a 15-point penalty for false accounting practices relating to player salaries and transfers. Bans were also handed out to 11 individuals, including former president Andrea Agnelli and Tottenham’s managing director Fabio Paratici. The club will appeal the decision, although it is already out of contention to win this year’s Scudetto, trailing frontrunners Napoli by a distance.

On the economic data front, retail sales in the UK unexpectedly fell in December. The volume of sales declined 1% whilst most analysts expected the Christmas shopping season to increase sales from the month earlier. Double digit inflation is squeezing purchasing power and widespread industrial action has hampered both instore and online shopping.

Oil continued to recover for a second straight week and Brent Crude rose $4 to $88 a barrel, its highest level since mid-November. In its latest report, the International Energy Agency forecast global demand for oil will rise to an all-time high this year as the Chinese economy fully reopens and supply is unlikely to keep up, especially with the West imposing more sanctions on Russia.